Tariffs and Trade Disputes

How are recent moves affecting businesses in the Fifth District?

On July 6, 2018, a U.S. cargo ship raced across the Pacific toward the port of Dalian in China. Its mission: make landfall and unload its cargo of soybeans before a 25 percent Chinese tariff went into effect at noon. Unfortunately for the U.S. shippers and the Chinese buyers, the boat arrived a few hours too late.

China's tariffs on nearly $34 billion in U.S. exports — including food products, such as soybeans and pork, and other products, such as cars — were a response to tariffs imposed by the United States on a similar amount of Chinese exports on manufacturing inputs and capital equipment. In late August, the United States raised tariffs on an additional $16 billion of Chinese exports, and China responded in kind.

President Donald Trump has made trade policy a focus of his administration. His first major action this year came in March when he implemented a 25 percent tariff on steel and a 10 percent tariff on aluminum. They are the first significant tariffs on steel imports since President George W. Bush raised tariffs on steel in 2002, later removing them in 2003. In recommending the tariffs to President Trump, the Commerce Department said that the measure was intended to increase domestic steel and aluminum production. Initially, key U.S. trading partners such as Canada, Mexico, and the European Union (EU) were exempt. But the Trump administration ended the exemptions in June, prompting Canada, Mexico, and the EU to respond with tariffs of their own.

This flurry of tariff activity is significant in the modern era. Recent decades have seen most developed nations move toward opening up their markets to foreign trade. According to the World Bank , the weighted average of U.S. tariffs across all imports in 2016 was just 1.6 percent, similar to that of the EU. What is behind the new rise of trade barriers, and how will they affect businesses in the Fifth District?

, the weighted average of U.S. tariffs across all imports in 2016 was just 1.6 percent, similar to that of the EU. What is behind the new rise of trade barriers, and how will they affect businesses in the Fifth District?

The Trade Debate

For most of the postwar era, trade grew faster than world GDP. After World War II, Allied leaders were interested in getting the world economy back on track and avoiding the isolation and protectionism that many blamed for the Great Depression. Under the General Agreement on Tariffs and Trade, which later became the World Trade Organization (WTO), member nations agreed to work together to reduce tariffs and other trade barriers. World trade accelerated rapidly in the 1990s and early 2000s with the dissolution of the Soviet Union and the entry of China into the WTO.

"Should We Worry about Trade Imbalances?" Economic Brief, October 2017.

Most economists view this expansion of trade as a good thing. For example, 85 percent of economists responding to a 2012 survey by the University of Chicago's Initiative on Global Markets (IGM) Forum agreed that freer trade allows firms to improve production efficiency and offers consumers better choices. While some industries are harmed by exposure to foreign competition, economists generally agree that in the long run, the overall gains from trade are much larger than the losses for some industries.

That said, some economists have recently noted that the costs of open trade may be larger and more persistent for affected industries and workers than previously thought. Traditional economic models have assumed that workers in harmed industries could easily transition to businesses that benefit from trade. But in a series of research papers, David Autor of the Massachusetts Institute of Technology, David Dorn of the University of Zurich, and Gordon Hanson of the University of California, San Diego found that this transition process may not work as smoothly as economists hypothesized.

Autor, Dorn, and Hanson found that China's entry into world markets beginning in the 1990s significantly hurt manufacturing workers in southern states, such as North Carolina, Tennessee, and Mississippi. Those regions experienced higher unemployment for a decade after the initial China trade shock, and some workers in impacted industries experienced lower annual earnings relative to workers in regions that were less exposed to trade with China.

The Trump administration has also emphasized the costs of unrestricted trade. To impose tariffs on China, President Trump invoked the Trade Act of 1974, which empowers the president to take action in response to trade practices by foreign governments that either violate international agreements or are "unjustified" or "unreasonable." The Trump administration has alleged that China has used improper practices to obtain intellectual property from U.S. companies. President Trump has also voiced a desire to reduce the U.S. trade deficit, which he attributes to unfair practices on the part of U.S. trading partners. In imposing the steel and aluminum tariffs, the president cited national security concerns and the need to protect America's metal industry and its workers.

But tariffs entail costs as well. Tariffs imposed by the United States on other countries raise the cost of imports. They may also raise the price of the same goods produced domestically since U.S. producers face less competition from foreign producers subject to the tariffs. Tariffs imposed by other nations on the United States raise the costs domestic exporters face in those markets. What costs will recent tariffs impose on importers and exporters in the Fifth District?

Fifth District Manufacturing

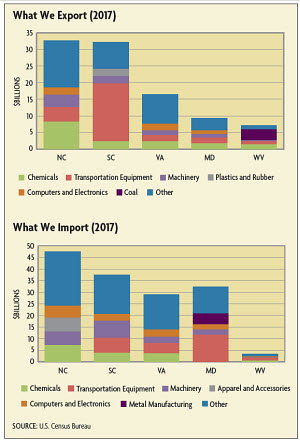

South Carolina is one of the biggest exporters in the Fifth District, shipping around $32 billion in goods in 2017, roughly 15 percent of the state's GDP. A significant portion of those exports came from South Carolina's growing manufacturing sector, specifically transportation manufacturing. South Carolina's largest category of exports is transportation equipment, which includes cars, car parts, airplanes, and airplane materials. BMW's plant in Spartanburg, S.C., employs 10,000 people and was the largest U.S. automobile exporter by value in 2017. Workers at Boeing's facility in North Charleston, S.C., assemble and ship the firm's new 787 Dreamliners. All told, transportation equipment accounted for more than half of the value of the state's exports in 2017. (See charts below.)

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.