Is Cash Still King?

Despite new technologies for electronic payments, cash has never been more popular. What's driving the demand?

In Sweden, signs declaring "no cash accepted" or "cash free" are becoming commonplace. In 2018, more than half of households surveyed by the Riksbank (Sweden's central bank) reported having encountered a business that refused to accept cash, compared with just 30 percent four years earlier. Many banks in Sweden no longer accept cash at the counter. Customers can still rely on ATMs for their cash needs, but those are becoming increasingly scarce as well, falling from 3,416 in 2012 to 2,850 in 2016.

In part, the country's banks and businesses are responding to changing consumer preferences. Use of debit cards and Swish, Sweden's real-time electronic payment system that launched in 2012, has surged in recent years while cash usage has steadily declined. Swedish law allows businesses to refuse to accept cash, and many firms have championed noncash payments as cheaper and safer than cash. (Thieves have also responded to Sweden's shift toward a cashless society. According to a recent article in The Atlantic, the country had only two bank robberies in 2016 compared with more than 100 in 2008.)

Given the spread of payment innovations around the world, one might expect that many other countries are following Sweden's example. But when it comes to cash, Sweden is an outlier. In a 2017 paper, Clemens Jobst and Helmut Stix of Austria's central bank measured currency demand for the United States and a handful of other countries going back to 1875. They found that while currency in circulation as a share of GDP has fallen over the last 150 years, that decline has not been very large given the evolution in payment technologies over the same period. Moreover, starting in the 1980s, currency demand in the United States actually began rising again.

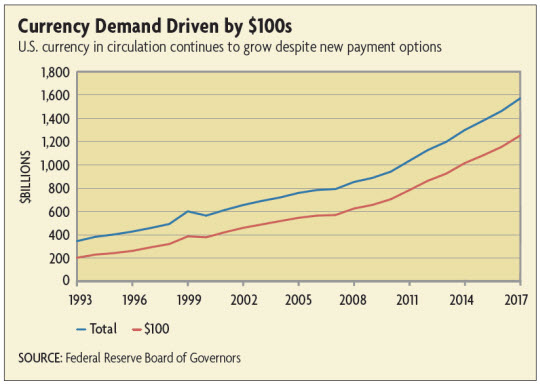

Over the last decade, dollars in circulation as a share of GDP have nearly doubled from 5 percent to 9 percent. Today there is $1.6 trillion in cash in circulation, or roughly $4,800 for every person in the United States. And the United States is hardly unique; cash in circulation has surged in recent years in much of the world despite the spread of new ways to pay.

"Consumer Payment Choice in the Fifth District: Learning from a Retail Chain," Economic Quarterly, First Quarter 2016.

As the number of dollars in circulation continues to swell, it raises an important question: What is driving the demand for cash? While monetary authorities that issue currency, such as the Fed, have good data on how much currency is out there, determining what happens to cash once it's in the wild presents a much bigger challenge.

Medium of Exchange

One way to understand the demand for cash is to study how people pay. Cash has a long history of facilitating exchange going back to the coins minted from precious metals and used by ancient civilizations. And despite the availability of new electronic payment options today, cash remains popular with consumers. According to the Survey of Consumer Payment Choice conducted by the Federal Reserve System, consumers used cash in 27 percent of transactions in a typical month in 2017, making cash the second most popular payment option after debit cards. That share has held fairly constant since 2008 when the survey began.

The Diary of Consumer Payment Choice, also published by the Fed, provides a more detailed snapshot of how consumers use cash. Participants are asked to record information about every payment they make over a three-day period. According to the latest data from the 2016 Diary, consumers frequently relied on cash for low-value purchases. Cash was used for more than half of all in-person purchases costing less than $10. In contrast, consumers used it in only 8 percent of purchases over $100.

"Consumers rate cash highly for being low cost and easy to use," says Claire Greene, a payments risk expert at the Atlanta Fed who works on the Survey and the Diary. "At the same time, there are other characteristics where cash rates poorly. It's dead last for record-keeping and rates poorly in terms of security." While consumers are protected from fraudulent charges to their debit or credit cards, cash comes with no such protection; once it's lost or stolen, it's gone. This may explain why most consumers are hesitant to carry enough cash for large purchases but are happy to use it for small ones.

The data also indicate that cash is an important payment option for low-income households. According to the 2016 Diary study, households that earned less than $25,000 a year used cash for 43 percent of their payments. Lower-income households are less likely to have access to some payment methods such as credit cards, making cash an attractive option. Indeed, a 2016 article by Zhu Wang and Alexander Wolman of the Richmond Fed illustrated the importance of cash for this demographic. Wang and Wolman studied billions of transactions from a national discount retail chain that primarily serves low-income households. They found that while the share of cash transactions declined from 2010-2013, cash was still used in more than 70 percent of purchases at the stores.

These data indicate that cash remains an important medium of exchange in the modern economy, but they don't explain the growing volume of dollars in circulation. Since consumers mostly use cash for small-dollar purchases, they typically don't carry much cash on them. The respondents to the 2016 survey had an average of $219 in cash on their person or property. That still falls short of the $4,800 per capita of U.S. currency in circulation. Who holds the bulk of that money, and how is it being used?

Flight to Safety

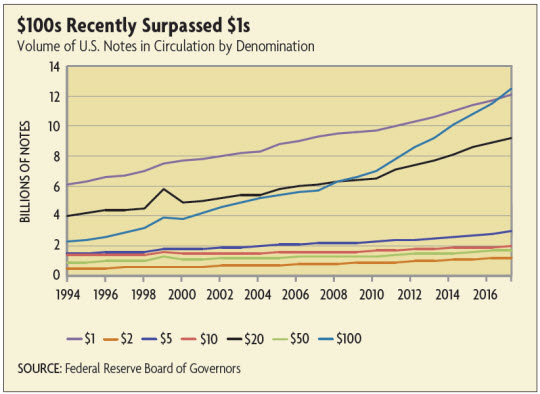

In addition to being used for exchange, cash also acts as a store of value. High-denomination notes are best suited for this purpose, so tracking their circulation can provide a sense of how important this aspect of cash is for explaining currency demand.

In the United States, large-denomination notes seem to be driving the growth in cash. The $100 bill accounts for most of the total value of currency in circulation. (See first chart below.) Demand for $100 bills has significantly outpaced other denominations in terms of pure volume as well, averaging an annual growth rate in notes of nearly 8 percent since 1995 compared with 3 percent to 4 percent for most other notes. In fact, in 2017, the $100 bill surpassed the $1 bill as the most widely circulated U.S. note. (See second chart below.)

While some of this demand may come from domestic savers, researchers believe a significant share of $100 bills are traveling overseas. Ruth Judson, an economist at the Fed Board of Governors, has spent years attempting to estimate how much currency is outside the United States using available data on cross-border currency flows and comparisons to similar economies whose currencies are not as widely used abroad.

"We think that the significance of foreign demand is unique to the dollar," says Judson. "Other currencies are also used outside their home countries, but as far as we can tell, the dollar has the largest share of notes held outside the country."

One way to measure the importance of foreign demand for the dollar is to compare currency circulation in Canada and the United States. Both have similar payment technologies and are close to each other in geography and economics, but the Canadian dollar is not as widely used in other countries. In 2017, Canadian dollars in circulation were equivalent to 4 percent of the country's GDP, or less than half of the U.S. share. Using this as a starting point, Judson estimated in a 2017 paper that as much as 70 percent of U.S. dollars are held abroad. Additionally, Judson estimated that as much as 60 percent of all Benjamins are held by foreigners.

"Overseas demand for U.S. dollars is likely driven by its status as a safe asset," says Judson. "Cash demand, especially from other countries, increases in times of political and financial crisis."

Some countries, such as Ecuador and Zimbabwe, have adopted the dollar as their primary currency in response to economic crises or pressures on their own currencies. And U.S. Treasuries as well as dollars remain safe-haven assets in times of global distress, like the financial crisis of 2007-2008. For example, Judson found that while international demand for dollars began to decline in 2002 after the introduction of the euro, that trend reversed after the 2007-2008 crisis.

Crises prompt domestic households to seek the safety of currency as well. In their 2017 paper, Jobst and Stix found that even countries without strong international demand for their currency experienced increased cash demand after 2008. Their analysis suggests that heightened uncertainty following the global financial crisis may explain some of the widespread currency growth over the last decade.

Another factor that may be contributing to the recent growth in cash demand is the historically low cost of holding it. Inflation creates a disincentive to hold cash since it erodes its value over time. But over the last decade, the United States and much of the rest of the world have experienced very low inflation and interest rates. Japan has experienced low inflation and near-zero interest rates for decades, which may partly explain why its ratio of currency in circulation relative to its GDP is nearly 19 percent, the highest among developed economies.

But even the best estimates of dollars held abroad or in domestic safes or under mattresses still leave a significant amount of cash unaccounted for. Some researchers argue that there is another source for the growing demand for high-denomination notes: the underground economy.

The Costs of Cash

"A key thing about cash is that it's anonymous and hard to trace," says Kenneth Rogoff of Harvard University. In his 2016 book The Curse of Cash, he argued this makes cash the ideal medium of exchange for consumers who value privacy, both for legitimate and illegitimate reasons. "There's a lot of evidence that cash plays a big role in tax evasion and crime," says Rogoff.

Even setting aside the U.S. dollars circulating overseas, Rogoff estimates that cash used in the domestic economy to hide otherwise legal transactions from tax authorities plays a significant role in roughly $500 billion in lost federal revenues annually. Cash is also used in illegal businesses like drug trade, human trafficking, and terrorism.

In addition, high-denomination notes are targets for counterfeiting, requiring monetary authorities to develop new security features to stay ahead of counterfeiters. Although authorities estimate that the volume of counterfeit dollars in circulation today is small, it has been a costly problem for the United States in the past. (See "The Counterfeiting Weapon," Region Focus, First Quarter 2012.) And staying on top of new counterfeiting threats to ensure today's cash is genuine is not without cost.

The availability of large-denomination notes may also impose costs on monetary policymakers, Rogoff argues. During the Great Recession, the Fed lowered its interest rate target to near zero, but some economists argued it should have gone even lower. Cash poses a potential problem for maintaining negative interest rates, however, because households and businesses can choose to hold cash instead of assets that bear a negative rate of interest. (See "Subzero Interest," Econ Focus, First Quarter 2016.) Of course, there is some cost to holding large sums of cash, which means that in practice central banks could reduce rates into slightly negative territory, as the European Central Bank has done with its deposit rate. Importantly, as Rogoff shows in his book, it is possible to use taxes and subsidies on deposits of cash at the central bank to create significant space for negative rates without otherwise changing anything about cash. But the availability of cash, especially large-denomination notes, nevertheless imposes some floor on how low interest rates can go.

Despite these costs, Rogoff doesn't advocate for completely eliminating physical cash, at least not anytime in the foreseeable future.

"It's really about regulating it better," he says. One option to regulate cash would be to track it better at the point of sale, using modern scanners to record serial numbers, for example. This would make cash less anonymous, which Rogoff argues would largely eliminate much of the demand for it.

"If there is no way for criminals to launder cash back into the system, the demand for cash for tax evasion and illegal transactions will drop," he says.

Another way to potentially reduce some of the costs associated with cash would be to eliminate higher-denomination notes. As data from the Fed Survey and Diary studies suggest, cash in the legal economy is mainly used for small-value purchases, which would be unaffected by the elimination of large notes. On the other hand, underground economic activity is more reliant on the portability of large-denomination notes. Eliminating large-denomination notes would also increase the cost of holding cash to avoid negative interest rates, perhaps loosening the lower-bound constraint on monetary policymakers.

"For most people, it would be good to still have cash for small transactions," says Rogoff. "But that's not an argument for keeping $100 bills, many of which are concentrated in the wrong hands."

Indeed, some regions have already moved to eliminate high-denomination currency. The eurozone ended production of the 500 euro note in 2016, citing concerns that it was being used to "facilitate illicit activities."

Some have speculated that these steps could be taken even further, by replacing cash with new digital alternatives.

Cash 2.0?

Can new technology provide the benefits of cash without the costs? With the advent of cryptocurrencies like Bitcoin, it's a question more researchers have been asking. In light of the decline in cash use in Sweden, the Riksbank has begun investigating the possibility of issuing an electronic currency. A recent paper from the Bank for International Settlements argued that issuing digital currency could provide new monetary policy options for central banks, but it would also raise new questions about the central bank's role in providing payment and banking services to the public.

The Fed has stated it has no plans to issue a digital currency, and in a forthcoming paper with Charles Kahn of the University of Illinois at Urbana-Champaign and Francisco Rivadeneyra of the Bank of Canada, Richmond Fed economist Tsz-Nga Wong argued that the central bank wouldn't have much comparative advantage in issuing one anyway. Electronic money requires different safeguards from cash to ensure that each transaction is properly authorized and that payers are not attempting to spend the same digital dollar twice. Decentralized networks, such as Bitcoin, solve this problem by recording all transactions on a public ledger and relying on other users to verify transactions. This verification process is slow and energy inefficient — but moving the public ledger to the central bank's ledger wouldn't make much difference.

Another solution is to rely on trusted intermediaries to manage user accounts and verify transactions. This system already exists in the private financial sector. Whenever individuals make electronic payments using the ACH network or a credit or debit card, financial intermediaries verify the transaction and manage the transfer of funds from payer to payee. In order to implement the same account-based verification system for central bank-issued digital currency, individuals would need to open accounts with the central bank. Today, the Fed needs to settle only a relatively small number of transactions between banks each day after banks have aggregated their own transactions. It would be much costlier for the Fed to directly manage a significantly larger number of frequently used retail accounts for every consumer in the country, a problem the private financial system has already solved. Replacing bank accounts with central bank electronic currency would also destroy the social value created by the private financial system, which reallocates balances in checking accounts and deposits to business loan and investment.

Physical cash also offers some advantages over digital currency. It is not susceptible to theft or disruption from cyberattacks, and it offers users anonymity that account-based digital money lacks. While this anonymity facilitates illegal transactions, as Rogoff argues, it also grants law-abiding consumers a measure of privacy. Overall, taking cash digital would not be a simple swap.

"I definitely don't favor getting rid of cash anytime soon," says Rogoff. "In the end, it's a cost-benefit analysis, and the benefits of cash are not zero."

Readings

Federal Reserve Bank of Atlanta Consumer Payments

Jobst, Clemens, and Helmut Stix. "Doomed to Disappear? The Surprising Return of Cash Across Time and Across Countries." Centre for Economic Policy Research Discussion Paper No. DP12327, September 2017.

Judson, Ruth. "The Death of Cash? Not So Fast: Demand for U.S. Currency at Home and Abroad, 1990-2016." Paper presented at the International Cash Conference, April 2017.

O'Brien, Shaun. "Understanding Consumer Cash Use: Preliminary Findings from the 2016 Diary of Consumer Payment Choice." Federal Reserve Bank of San Francisco Fednotes, November 28, 2017.

Wang, Zhu, and Alexander L. Wolman. "Payment Choice and Currency Use: Insights from Two Billion Retail Transactions." Journal of Monetary Economics, December 2016, vol. 84, pp. 94-115.

Receive an email notification when Econ Focus is posted online.

By submitting this form you agree to the Bank's Terms & Conditions and Privacy Notice.