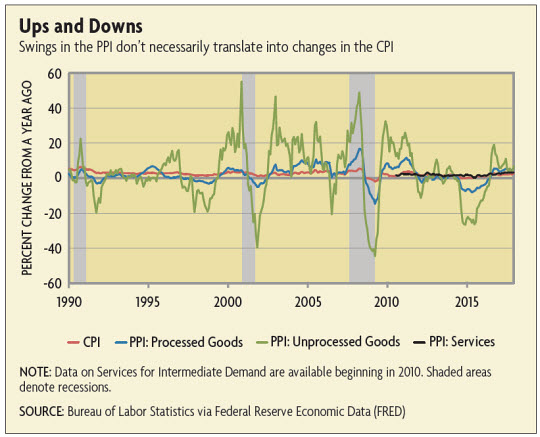

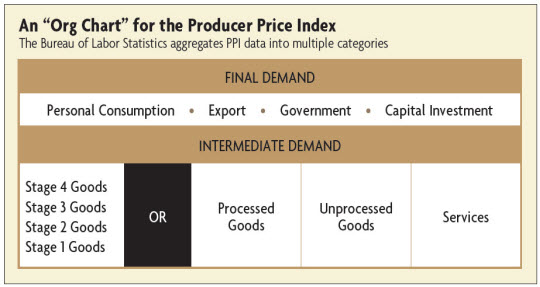

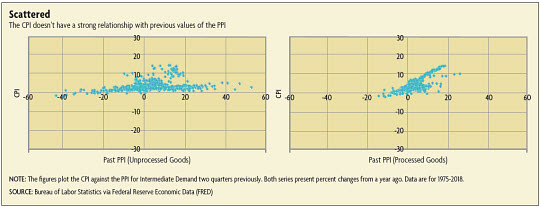

In a 2016 article, Jonathan Weinhagen, an economist at the BLS, found that price increases in earlier stages of intermediate demand did help predict price increases at later stages in the PPI. So why isn't there a stronger relationship between the CPI and the PPI? One reason might be that both measures are averages across a large number of different industries. There are some industries in which higher input prices do translate directly into higher consumer prices, but these "pass through" effects could be masked when they're averaged with industries with different cost structures. For example, increases in food-related PPIs tend to lead to increases in the CPI for food purchased in grocery stores but not for food purchased at restaurants, where service and preparation are a large part of the value.

The relationship, or lack thereof, between the PPI and CPI also reflects the measurement differences. For example, the exclusion of imports, which account for about 15 percent of GDP, means that the PPI doesn't reflect any cost savings producers achieve from buying intermediate inputs overseas. Nor does it reflect cost increases if imports become more expensive, for example because of tariffs. (See "Tariffs and Trade Disputes" in this issue.)

In addition, growing global trade in intermediate inputs means that the baskets of goods measured in the CPI and the PPI have less and less in common over time. In a recent working paper, Shang-Jin Wei and Yinxi Xie of Columbia University documented a growing divergence between producer price indexes and consumer price indexes in most industrialized countries, including the United States, beginning around 2001. They attributed this divergence to the increasingly global nature of many companies' supply chains.

Making the Markup

While there is some evidence that producers pass on cost increases, intermediate input costs are just one factor in a firm's pricing decisions. A firm also has to consider labor and capital costs and the competitive landscape, all of which affect how much a firm marks up the prices of its goods over intermediate input costs. "If all these conditions were static, then yes, one might expect to see a consistent and stable relationship between the prices of materials inputs and the prices of finished goods," says Alex Wolman, vice president for monetary and macroeconomic research at the Richmond Fed. "But of course, these conditions aren't static."

One of the most important considerations is the customer. While it won't come as a huge surprise to most shoppers, a large body of research has demonstrated that different firms charge different prices for essentially the same goods, and that the same firm may charge different prices at different times. Nicholas Trachter of the Richmond Fed, with collaborators elsewhere, has shown how this price dispersion can arise based on the variation in consumers' abilities and willingness to shop around, and how stores employ pricing strategies in response. The more costly it is for a consumer to search for a different seller, either because other sellers are hard to find or because the consumer is unwilling to spend much time searching, the higher the price a given firm can charge.

In this respect, the Internet might be one factor making it more difficult for producers to raise prices, both by making it easier for customers to shop around and by making it easier for new companies to set up shop. Procter & Gamble, for example, announced last year it was cutting prices on its Gillette razors by up to 20 percent in response to competition from online retailers. Fed Chairman Jerome Powell attributed low inflation in part to the "Amazon effect" in his semiannual testimony before the Senate Banking Committee in March. (The Internet isn't the first technology to affect prices; see "The Great Telegraph Breakthrough of 1866.")

Another factor potentially limiting firms' abilities to pass on cost increases is the concentration of the retail sector: In 2017, the five largest retailers in the United States accounted for 36 percent of the 100 largest retailers' total U.S. sales. And when retailers get large enough, they may be able to exercise what's known as monopsony power, where they are effectively the only buyer and can dictate terms and prices to their suppliers.

Many manufacturers have reported being forced to sell their products at lower prices lest they lose their place on a store's shelves. Some companies might even get large enough for this to affect the economy as a whole. In the early 2000s, for example, Jerry Hausman of the Massachusetts Institute of Technology estimated that Walmart and its ilk had lowered annual food price inflation by three-quarters of a percentage point.

Retail isn't the only sector that's highly concentrated; concentration has been increasing across all public firms since the late 1990s. (See "Are Markets Too Concentrated?" Econ Focus, First Quarter 2018.) Intuitively, one would expect greater market concentration to enable firms to raise prices, but economists studying market power have come to conflicting conclusions about the extent to which markups have increased economy-wide. One way that increasing market concentration could coexist with low prices is if the firms that have grown large are also the firms that have built their strategy around low prices — and thus exert their influence over their suppliers rather than their customers.

In the Long Run

Another reason producers might not be willing or able to pass on higher input costs could be the virtuous circle of inflation expectations. Economists have found that one of the most important determinants of future inflation is what people expect inflation to be. So if firms believe the central bank is committed to keeping inflation low and stable, they won't try to raise prices beyond that rate — which, in turn, contributes to keeping inflation low and stable. (See "Great Expectations" in this issue.) Most measures of inflation expectations have ticked up in recent months, but they remain relatively low and well-aligned with the Fed's 2 percent target for the inflation rate.

Even if firms in sectors with rising input costs were to pass on those costs to consumers, it wouldn't necessarily lead to inflation in the sense that monetary policymakers use the word, to mean a persistent increase in prices across the entire economy. In the short run, changing supply and demand conditions might lead to higher prices for certain goods and services. But in the long run, under this definition, inflation is determined by monetary policy, and those supply and demand conditions affect only relative prices of the particular goods and services. "If apples get more expensive relative to oranges, that's not inflation," says Clark. "Inflation is when prices increase for both apples and oranges — and everything else."

The relationship between the PPI and CPI illustrates the complex interactions between costs and competition that influence firms' pricing decisions. And while the PPI might not be a perfect harbinger of what's to come, it's still a valuable indicator for policymakers. "It's one of many tools we can use to assess the overall state of the economy and where we are in the business cycle," Clark says. "It's useful even if it's not predictive of the inflation measure we've chosen to target."

Readings

Bognanni, Mark, and Tristan Young. "An Assessment of the ISM Manufacturing Price Index for Inflation Forecasting." Federal Reserve Bank of Cleveland Economic Commentary No. 2018-05, May 24, 2018.

Clark, Todd E., "Do Producer Prices Lead Consumer Prices?" Federal Reserve Bank of Kansas City Economic Review, Third Quarter 1995, pp. 25-39.

Menzio, Guido, and Nicholas Trachter. "Equilibrium Price Dispersion Across and Within Stores." Review of Economic Dynamics, April 2018, vol. 28, pp. 205-220. (Article available with subscription.)

Weinhagen, Jonathan C. "Price Transmission within the Producer Price Index Final Demand-Intermediate Demand Aggregation System." Bureau of Labor Statistics Monthly Labor Review, August 2016.

. He found that, historically, changes in the PPI had to some extent preceded changes in the CPI, but he also found that the PPI was of little value in forecasting future values of the CPI, which suggested that the producer price changes weren't necessarily driving the consumer price changes.

. He found that, historically, changes in the PPI had to some extent preceded changes in the CPI, but he also found that the PPI was of little value in forecasting future values of the CPI, which suggested that the producer price changes weren't necessarily driving the consumer price changes. , but more recent research also suggests that changes in input prices are not a good predictor of future inflation. In a 2018 article

, but more recent research also suggests that changes in input prices are not a good predictor of future inflation. In a 2018 article , Mark Bognanni and Tristan Young, also with the Cleveland Fed, studied the predictive power of the ISM Manufacturing Price Index, another measure of input prices; it did help to improve forecasts of the PPI, but that did not translate into improving forecasts of changes in the index of Personal Consumption Expenditures, or PCE (the consumer inflation measure generally used by the Federal Open Market Committee).

, Mark Bognanni and Tristan Young, also with the Cleveland Fed, studied the predictive power of the ISM Manufacturing Price Index, another measure of input prices; it did help to improve forecasts of the PPI, but that did not translate into improving forecasts of changes in the index of Personal Consumption Expenditures, or PCE (the consumer inflation measure generally used by the Federal Open Market Committee).