I Spy with My PPI … More High CPI?

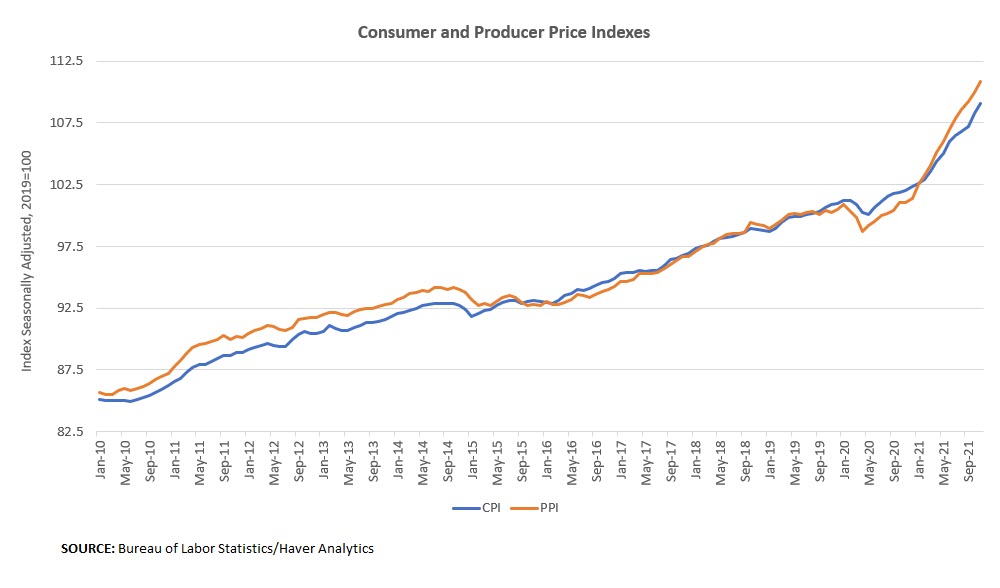

With inflation having run at the fastest pace in decades in 2021, this year's inflation outlook feels more uncertain. On the one hand, the economy may have already weathered the worst of the supply disruptions and elevated prices for products like new and used vehicles may be poised to return to normal. On the other hand, some indicators suggest more high inflation is on the horizon. As shown in Figure 1 below, the seasonally adjusted Producer Price Index (PPI) rose 0.8 percent in November, to a 9.7 percent year-over-year rate. In comparison, the seasonally adjusted Consumer Price Index (CPI) rose 0.9 percent to a 6.9 percent year-over-year rate.

But the PPI isn't necessarily the best predictor of the CPI. So what does this mean for inflation going forward?

The question of what producer price inflation implies for future consumer prices has been studied for decades. A 1995 study by the Kansas City Fed found only a weak relationship between changes in producer prices and subsequent changes in consumer prices, while a New York Fed study the same year found the predictive power of PPI for core CPI inflation weakened starting in the mid-1980s. In a more recent paper from 2018, Shang-Jin Wei and Yinxi Xie find that PPI and CPI co-moved strongly prior to 2000 but have since diverged as globalization has driven a wedge between the baskets of goods that the two price indexes measure. And PPI may be more informative for some sectors than others: For example, according to the USDA's Economic Research Service, industry-level PPIs for foods and feeds "have historically shown a strong correlation with the all-food and food-at-home CPIs." (Check out this Econ Focus article for an overview of the studies about this topic.)

In this post, we take a fresh look at the relationship between PPI and CPI. This is of interest because the Bureau of Labor Statistics formally transitioned to a new method of calculating the PPI in 2014 that captures more parts of the U.S. economy, including services, construction, government purchases and exports. The studies cited above use PPIs calculated under the old methodology. In addition, with COVID-related supply constraints hitting almost every part of the economy, the relationship between producer and consumer prices might be stronger in more recent data.

"As the omicron variant has shown, the assumption of no shocks [to the economy] would be a heroic one to make."

To study these two series, we used a statistical model called a vector error correction model (VECM), which is able to estimate the short-term and long-term effects of one variable on another, as well as to allow variables to have potential feedback loops for one another. We estimated the VECM using monthly data on PPI and CPI from November 2009 through November 2021.

The model found evidence that the two price indexes move together over the long run — a relationship that economists call cointegration — but the model did not find statistically significant evidence that PPI affects CPI in the short term. Instead, it is the gap between the two series that matters most. If PPI and CPI begin to move away from their long-run relationship, the two series will adjust to normalize the gap over time, though this doesn't always mean that CPI will have to rise to catch up with PPI.

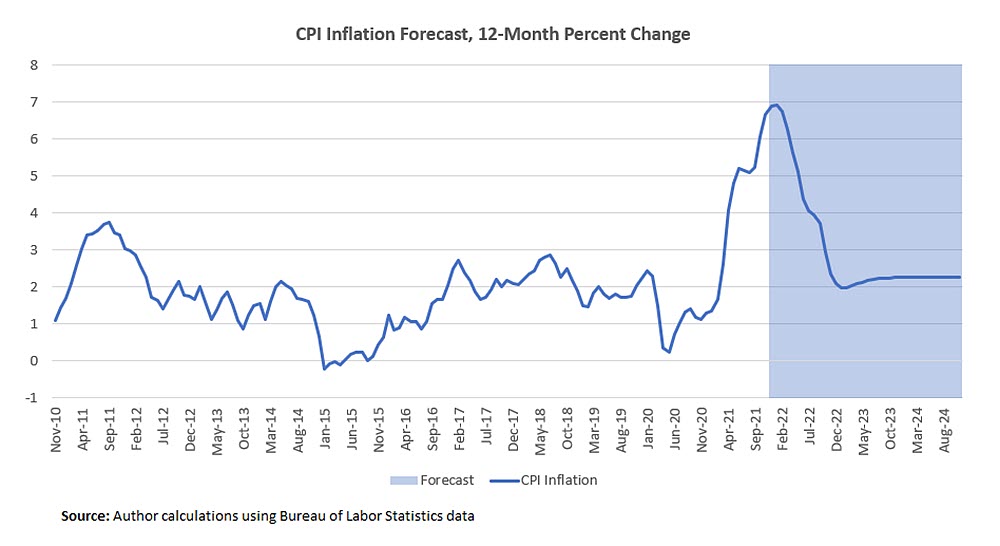

What do the latest PPI and CPI readings imply for CPI inflation in 2022? We can use our model to make a simple forecast of inflation, shown in Figure 2. Assuming no further shocks to consumer or producer prices in the future, the model suggests CPI inflation will remain well above 2 percent for most of this year, falling back to target by late 2022. On a monthly basis, the model predicts CPI inflation will decelerate from a 9.3 percent annualized rate in November 2021 to an average of 2.3 percent over 2022.

But the confidence interval around this forecast is wide. The 95 percent confidence interval around December 2022's inflation forecast indicates that year-over-year inflation could be anywhere between 0.1 percent and 4.1 percent. And as the omicron variant has shown, the assumption of no shocks would be a heroic one to make.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.