Inflation Staying Persistent

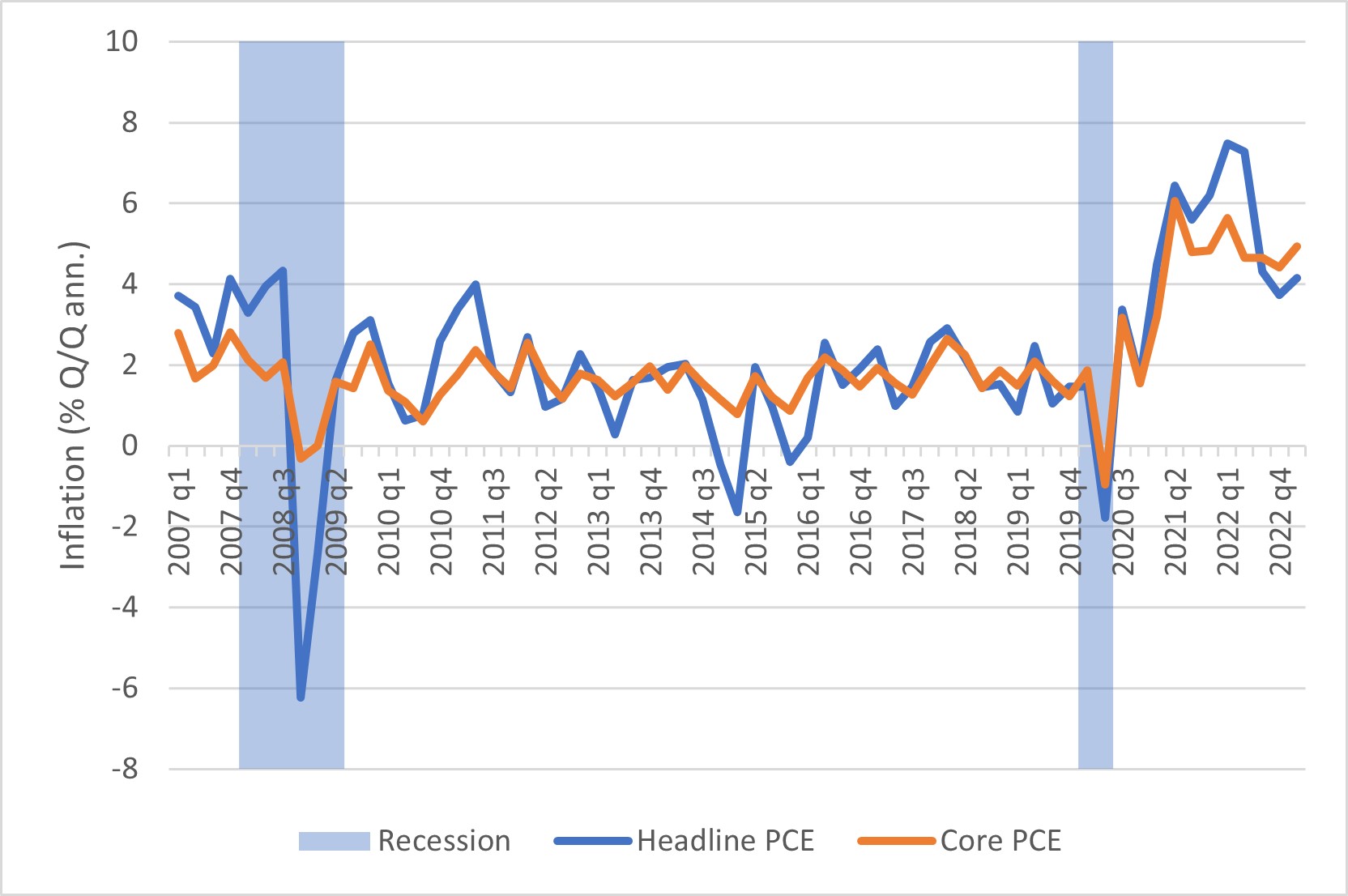

Recent inflation readings continue to come in below their COVID-19 era highs, but has the persistence of inflation also come down? As shown in Figure 1 below, in the advance GDP release for the first quarter of 2023, both the headline and core measures of personal consumption expenditures (PCE) inflation ticked up on a quarter-over-quarter basis but remain below their post-COVID-19 peaks.

While the first quarter readings point to inflation remaining persistent, perhaps inflation's fall from its post-COVID-19 peak has been enough to bring down estimates of inflation persistence. Higher inflation persistence means that levels of inflation in the last quarter are inherited by the current quarter, and the elevation inflation would imply a longer journey back to the Fed's 2 percent average long-run target. Lower persistence, on the other hand, would facilitate a quicker return of inflation to target.

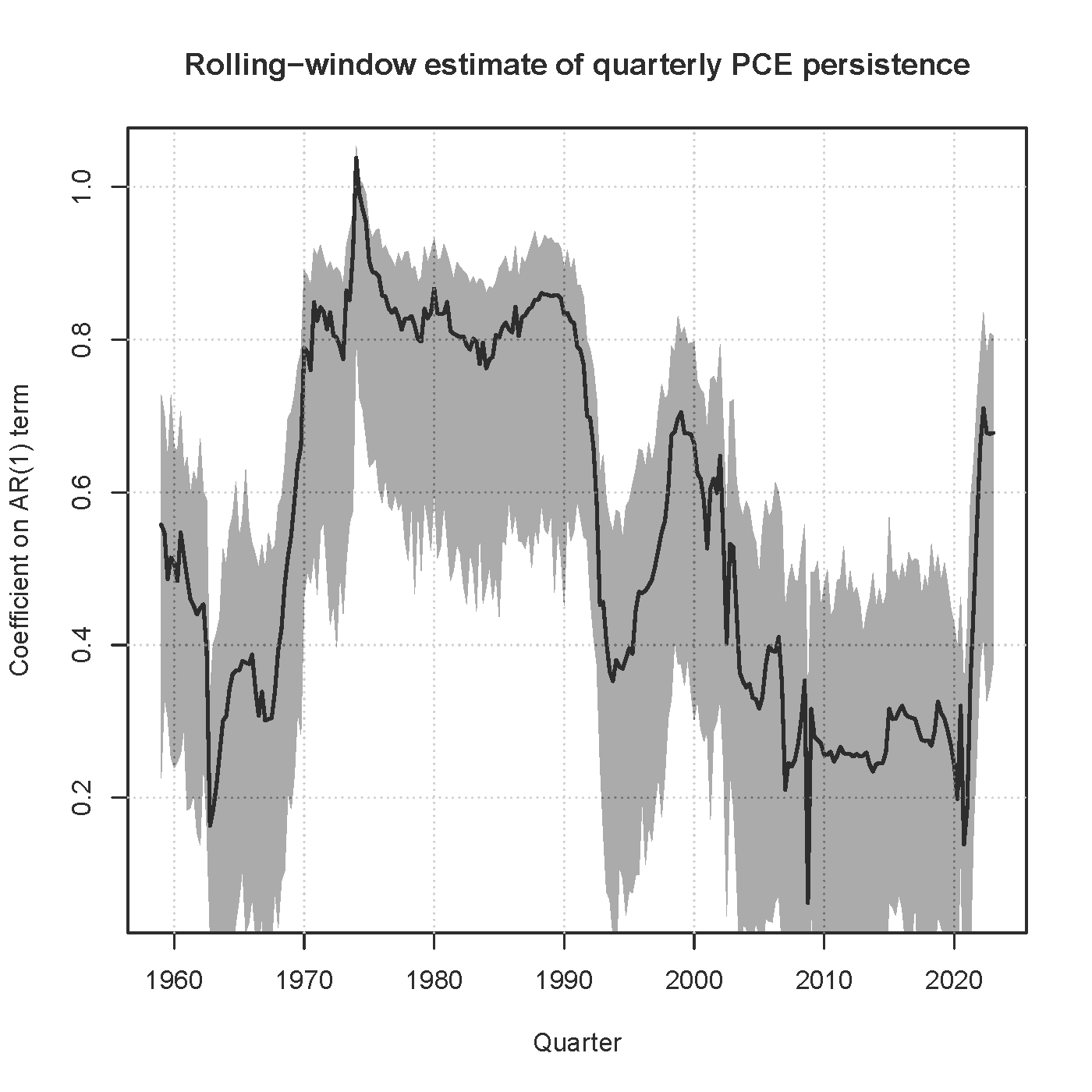

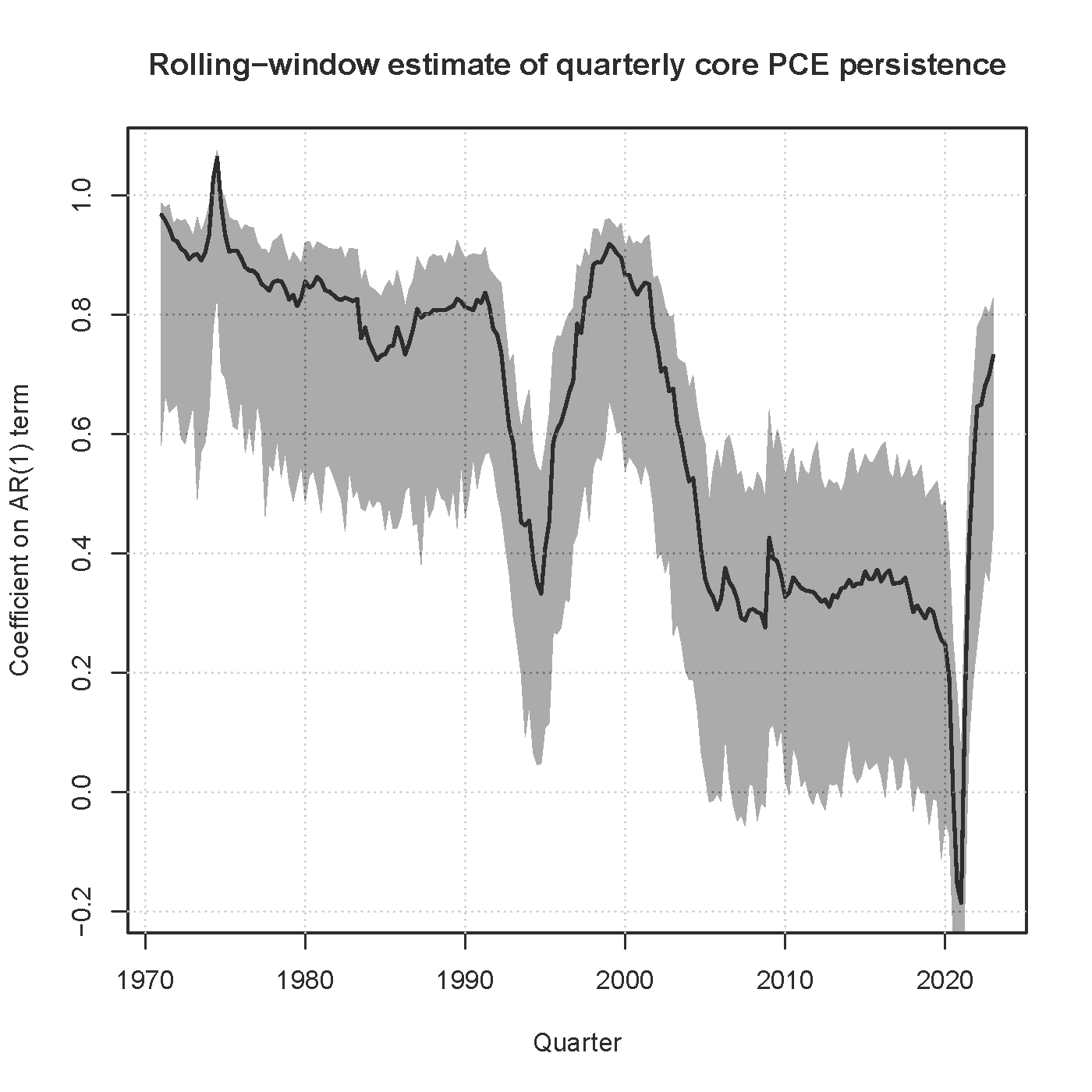

In this post, we'll look at a simple measure of inflation persistence that's calculated from estimating a rolling-window AR1 model on quarterly inflation data through the first quarter of 2023. (For discussion of more statistically sophisticated analyses of inflation persistence, please see our recent article "How Persistent Is Inflation?") The model estimates the degree to which inflation in the prior quarter is passed through to the level of inflation in the current quarter over a rolling 12-year time period. Higher estimates of the AR1 persistence coefficient imply a higher degree of inflation persistence.

Our findings for headline PCE inflation, shown in Figure 2 below, suggest that its persistence has fallen slightly from peak but remains near its 20-year high. The most recent data available show that, in the latest quarter of data (the first quarter of 2023), the persistence coefficient dropped from a post-COVID-19 high of 0.71 in the second quarter of 2022 to 0.68 in the first quarter of 2023. Prior to the pandemic, the last time headline PCE inflation persistence was that high was in 1999.

For core PCE inflation, the estimated persistence coefficient has increased to 0.73, a new post-COVID-19 high and the highest reading since the first quarter of 2002. Although recent core inflation may not be at its post-COVID-19 peak, it appears to be becoming more persistent at levels that are still far from target.

These results also don't seem to be sensitive to the length of the "look-back" window. Table 1 below shows that, when we look at longer and shorter horizons than the baseline 12-year rolling window, we still find that the estimated persistence of core PCE inflation reached a post-COVID-19 high in the latest quarter.

| Estimated Persistence of QoQ Core PCE Inflation | ||||

|---|---|---|---|---|

| Rolling-window length | 2023 Q1 | 2022 Q4 | Post-COVID-19 high | 2010-2019 average |

| 6 years | 0.68 | 0.66 | 0.68 | 0.25 |

| 12 years | 0.73 | 0.7 | 0.73 | 0.33 |

| 18 years | 0.69 | 0.65 | 0.69 | 0.35 |

Does this mean we're destined for a period of prolonged high inflation? Not necessarily. As shown in Figures 2 and 3, these statistical measures of inflation persistence have wide confidence intervals, and the confidence intervals of the most recent observation overlap with those observed just before the pandemic. This means it's technically possible that inflation persistence today might not be much different than what it was prior to COVID-19.

In addition, looking at what happened to inflation persistence during the pandemic shows that the relationship between inflation persistence and levels of inflation runs both ways. The estimated persistence of inflation dropped in early 2020 when the COVID-19 shock caused the level of inflation to plummet, and persistence rose when supply shocks contributed to raising inflation. Today's elevated inflation persistence could come down with similar speed if the economy experiences more shocks that cause price growth to slow or reverse.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.