Spending Growing at a Snail's Pace

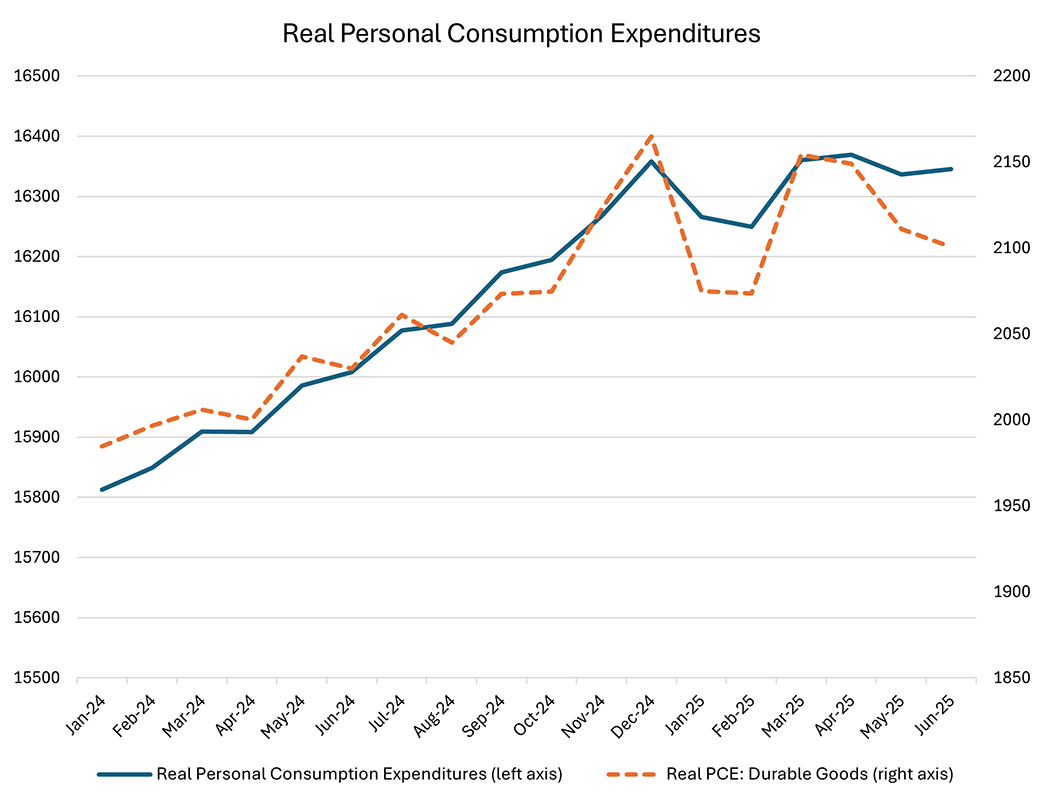

Consumer spending has slowed in 2025. Adjusted for inflation, personal consumption expenditures (PCE) in June were 0.07 percent below their December 2024 level. However, the recent slowdown in overall spending may mask shifts in the timing of consumer purchases. In particular, durable goods spending surged by an annualized 13.7 percent in the six months leading up to December 2024 but fell 5.8 percent annualized in the following six months, as seen in Figure 1 below. This suggests that a contributor to this year's slower spending is payback following a temporary pull ahead of spending.

In this week's post, we look at some features of the latest PCE report for evidence that this payback effect has contributed to today's slow spending rates.

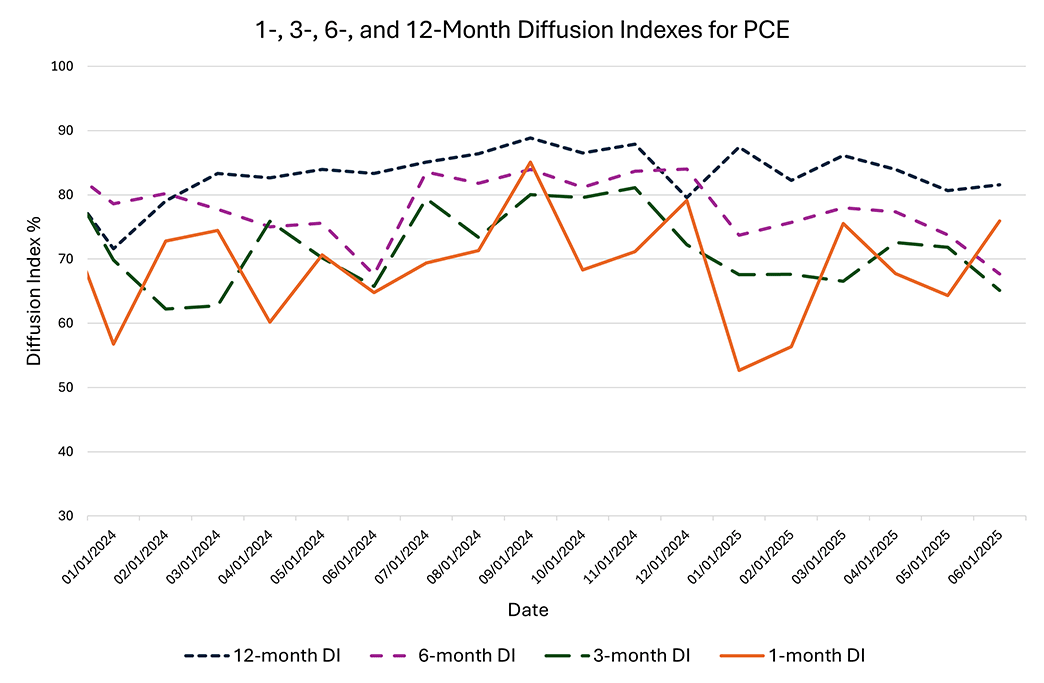

To better understand the nature of this year's slowdown, we recalculate a diffusion index that captures the breadth of consumer spending, introduced in an earlier Macro Minute post. The index is constructed by breaking down total PCE into 179 subcategories and examining whether inflation-adjusted spending rose over the past one, three, six and 12 months for each of these subcategories. For each period, we calculate the share of total expenditures falling into categories that saw positive real growth.

This approach allows us to detect whether spending gains are broad or are concentrated in just a few areas. If this year's recent slowdown in real PCE is attributable to payback effects in a few categories, we'd likely see only a modest decline in the diffusion indexes. In contrast, if the recent PCE slowdown is due to broad demand weakness, we'd likely see a larger decline in the diffusion indexes.

Figure 2 below plots each diffusion index for total PCE. Almost all of the indexes have declined versus their December 2024 readings, which aligns with the recent slowdown in overall spending. (The one exception was the 12-month index, though it should be noted that the current reading of 81.6 is well below November [87.9] and January [87.5].)

On the other hand, all diffusion indexes are above 50, indicating that the majority of PCE expenditure is in categories which continue to see real spending growth, suggesting that the slowdown has been driven by a few categories which may have experienced payback effects. Furthermore, the current levels of the diffusion indexes are within their ranges observed last year, which may be a sign that underlying demand momentum is not significantly slower than 2024's pace.

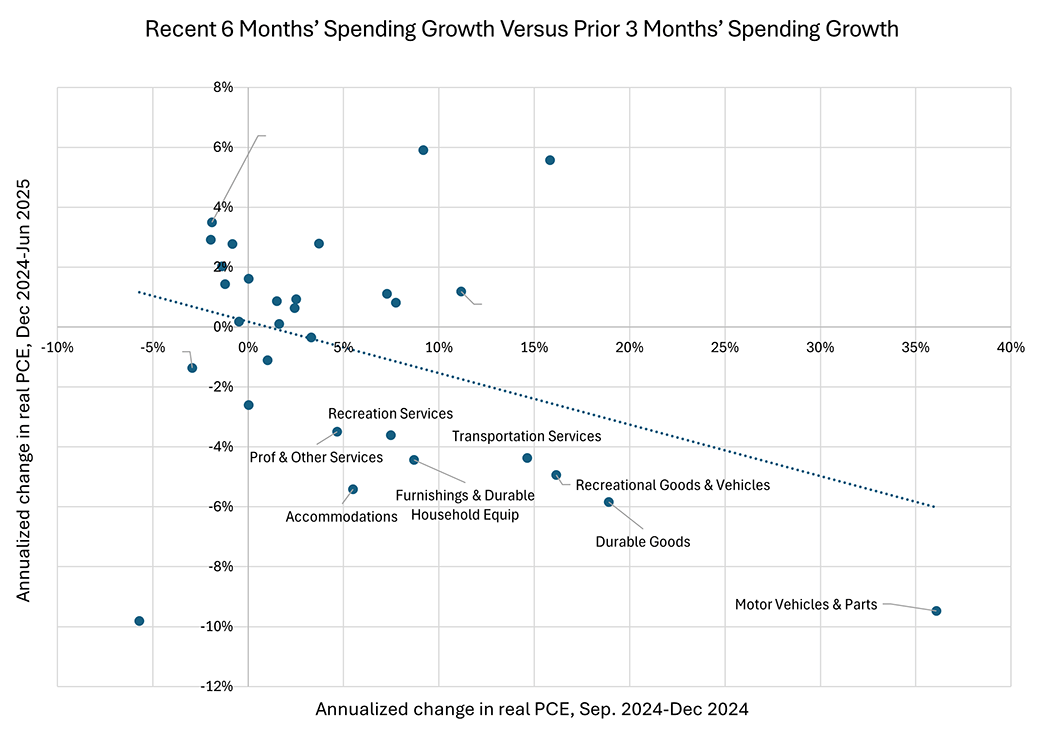

Another way to visualize the presence of payback effects is to plot recent spending growth rates against spending growth in a preceding period. Because payback effects are preceded by pull-ahead spending, we should see that the categories with higher growth rates in the preceding benchmark period also experience slower growth rates in the most recent data.

Figure 3 below plots the six-month annualized growth rate of real PCE categories from December 2024 to June 2025 (y-axis) against the spending growth rate of each category observed over a preceding three-month period from September 2024 to December 2024 (x-axis). Each dot corresponds to a type of PCE product (level 2 or 3) listed in the Bureau of Economic Analysis Table 2.4.6.U. Under the presence of payback effects, the relationship between the two growth rates should be negative: Faster spending in the earlier period is associated with a sharper decline in spending in the recent period. The fitted trend line in the scatterplot shows that this is the case.

Furthermore, while some categories seeing payback — such as recreation services, travel and accommodations — appear to be related to holiday spending, the points in the lower right quadrant of the figure furthest from the origin are associated with durable goods spending. Durable goods spending is most likely to be affected by pull-ahead and payback effects, in contrast to items like haircuts or perishable groceries. Of the 30 points on the chart, more than half (17) remain above the horizontal axis, indicating recent real spending growth. These findings suggest that payback effects could be a contributing factor to the recent sluggishness of consumption growth.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.