Hiring Problems Persist

Last summer, we looked at the industries having the most trouble hiring. In November, we noted that labor market mismatch was still elevated. Has there been any progress since then? Today we provide an update and find that according to one measure, hiring difficulties in the private sector are even worse than they were last summer!

"The drop in hires-per-job opening in the private sector is consistent with survey responses that continue to sound negative on labor availability."

There are good reasons to think the labor shortage is easing. Wages continue to grow, with average hourly earnings in the private sector 5.7 percent higher than last year. The unemployment rate is lower than it was last summer, which suggests that more people who were among the ranks of the unemployed and searching for work have been matched up with jobs. Labor force participation is higher — perhaps because pandemic fiscal support to households has been winding down — which increases the supply of available workers. Nonfarm payrolls are growing steadily — January payrolls are down 2.9 million from pre-pandemic levels, a sizeable gap but a long way from the 22 million jobs lost in April 2020.

Despite these improvements, one measure shows that labor supply still remains short of labor demand: the hires-per-job opening ratio. This metric comes from the Bureau of Labor Statistics' monthly Job Openings and Labor Turnover Survey, or JOLTS for short. The ratio is calculated for each industry by dividing the number of additions to payrolls in each month by the number of openings that remain on the last day of each month. A job is considered "open" if it meets all three of the following conditions:

- A specific position exists and there is work available for that position. The position can be full-time or part-time and it can be permanent, short-term, or seasonal.

- The job could start within 30 days, whether or not the establishment finds a suitable candidate during that time.

- There is active recruiting for workers from outside the establishment location that has the opening.

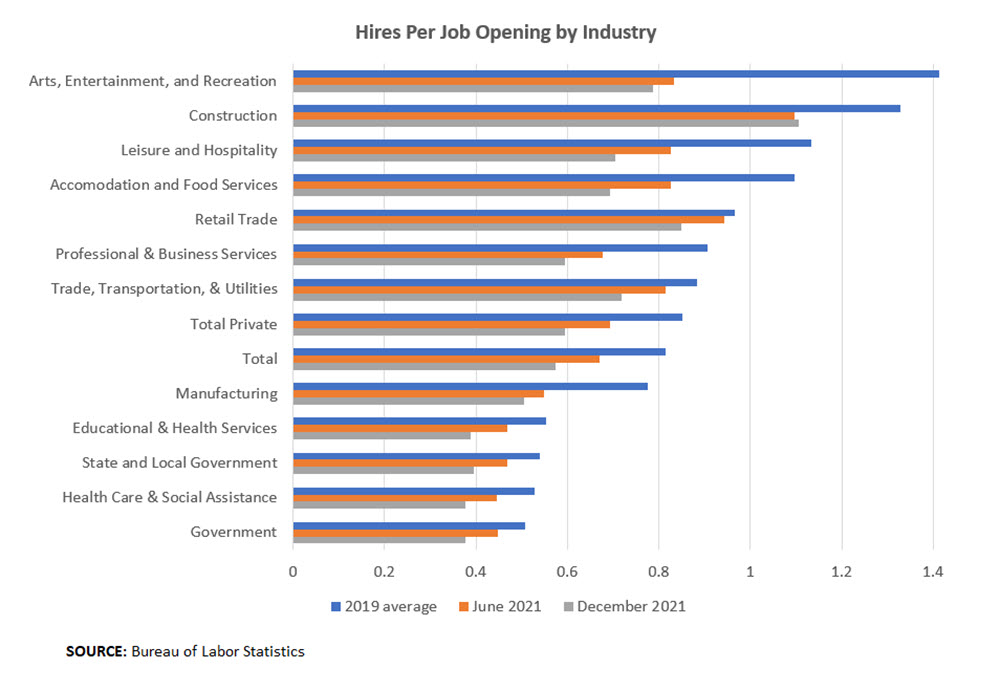

Figure 1 below shows that across many industries, except for construction, the shortfall in hires-per-job opening relative to the 2019 monthly average is even worse than it was in June 2021. And in all industries, the hires-per-job opening ratio is lower than it was in 2019. Employers continue to face difficulty converting job postings into employees.

The drop in hires-per-job opening in the private sector is consistent with survey responses that continue to sound negative on labor availability. For example, in January’s ISM Services report, comments included the following: "we will be forced to upgrade some equipment that is less reliant on labor," "available labor is nonexistent," and "professional labor continues to be in short supply." Manufacturers also reported "a lack of qualified labor," "lack of skilled production personnel," and "lack of supplier manpower."

Without relief in labor shortages, wages may have to rise yet further to attract workers, contributing to pressure on inflation this year.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.