Really Yearning for Real Earnings

April's nonfarm payroll report revealed another strong month for hiring, with employers adding 428,000 jobs to payrolls, the same increase as March. The report also pointed to sustained growth in wages: Average hourly earnings (AHE) for all employees on private nonfarm payrolls rose 10 cents to $31.85, an increase of 0.3 percent versus March and up 5.5 percent year over year.

But is that growth enough to keep up with inflation? In this post, we update our wages and inflation analysis from six months ago and look at whose wages have made real gains since the pandemic started. Below, we'll compare growth in AHE against two measures of inflation:

- Consumer price index (CPI) inflation

- Personal consumption expenditures (PCE) price index inflation

"... Employees in goods-producing industries have seen their wages fall since near the start of the pandemic after adjusting for inflation."

We've previously discussed differences between CPI inflation and PCE inflation, but it's worth a reminder that the Fed's preferred inflation measure (and the basis of its 2 percent inflation target) is PCE inflation. We include CPI inflation in this analysis because it's closely followed in the media and is released a couple weeks earlier than the PCE number.

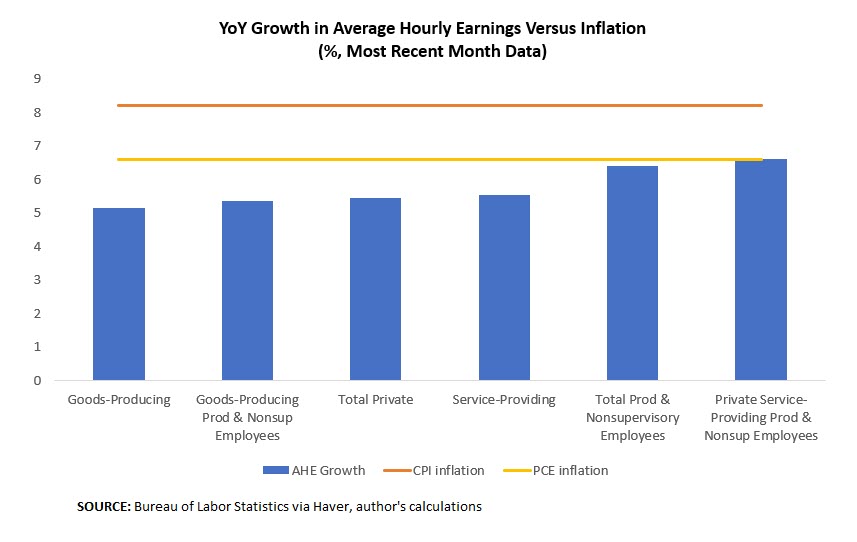

In April, CPI rose 0.3 percent for the month to an 8.3 percent year-over-year rate, down slightly from 8.5 percent year over year in March. The latest reading we have for PCE inflation is from March, where it rose 0.9 percent for the month to a 6.6 percent year-over-year rate, versus 6.3 percent year over year in April. In the figures that follow, the line for PCE inflation refers to this March value.

The first comparison is for wage growth and inflation over the past year. As shown in Figure 1, 5.5 percent year-over-year wage growth for all private sector employees has fallen short of CPI inflation of 8.3 percent and PCE inflation of 6.6 percent. The figure also shows that production and nonsupervisory employees have seen faster wage growth over the past year than the overall average, almost keeping up with PCE inflation. Within that category, service-providing employees have had the largest gains, with AHE keeping up with PCE inflation, though falling short of CPI inflation.

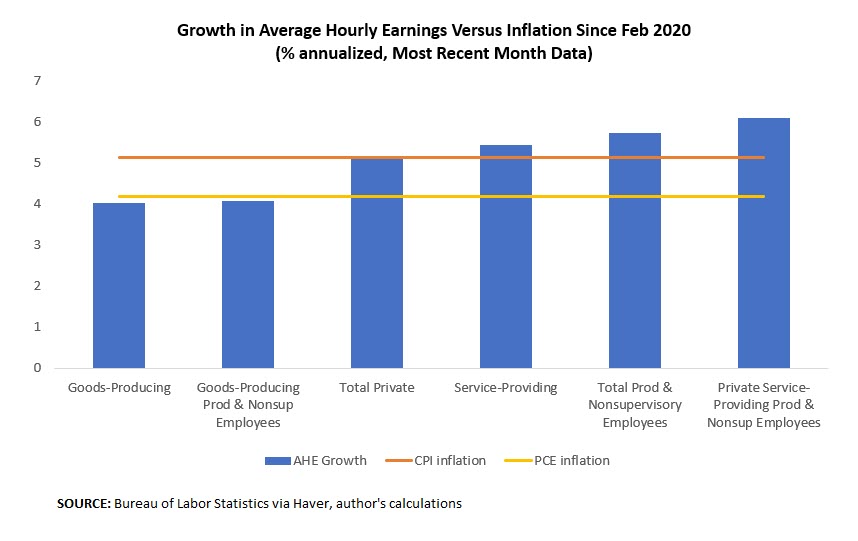

Figure 2 shows the same comparison for annualized AHE growth and inflation since February 2020, just before measures such as business and school closings took effect to battle the pandemic. Looking over this longer time span, AHE growth for all private sector employees has kept pace with CPI inflation, and production and nonsupervisory employees as well as service-providing employees have seen real gains in AHE since the start of the pandemic. However, employees in goods-producing industries have seen their wages fall since near the start of the pandemic after adjusting for inflation.

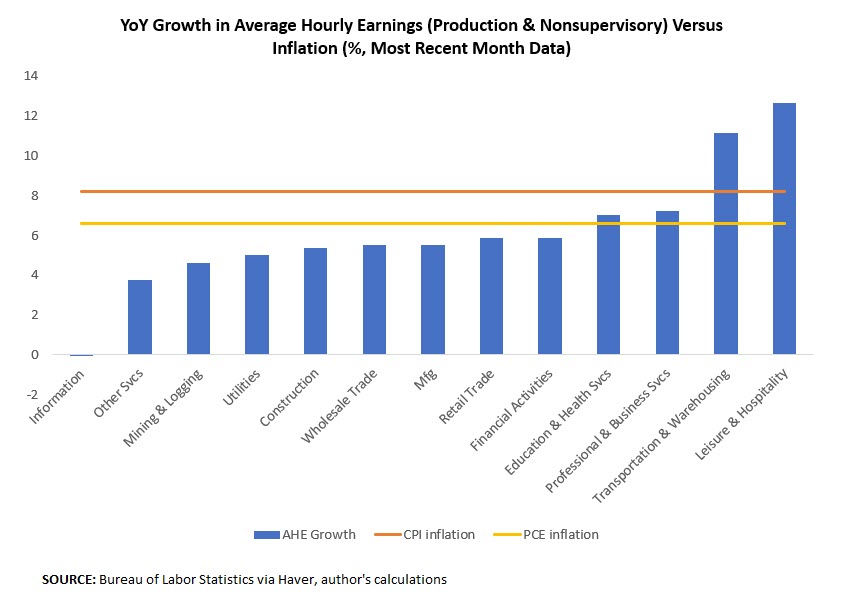

Finally, we take a deeper look across industries, focusing on AHE of production and nonsupervisory employees. Figure 3 shows this year-over-year comparison, indicating that only two industries — leisure and hospitality, and transportation and warehousing — have seen AHE gains outpacing CPI inflation. Two other industries — professional and business services, and education and health services — have had AHE gains that outpace PCE inflation but not CPI inflation.

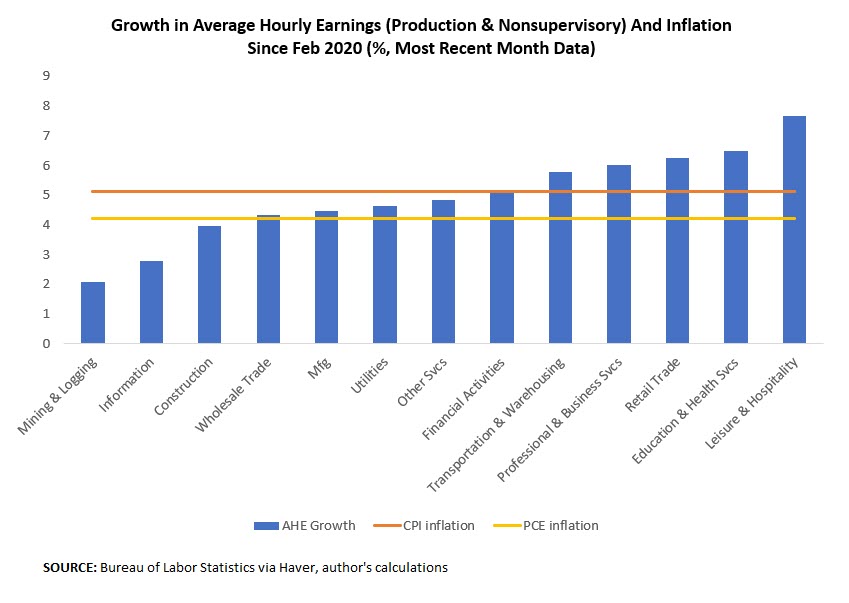

Figure 4 shows how these results change when looking at wage growth and inflation since near the start of the pandemic. As we saw earlier, looking across a longer time span creates a more favorable comparison. Only three industries — mining and logging, information, and construction — have seen AHE growth fall short of PCE inflation.

While some workers may feel comfort knowing their wages have not done worse since the pandemic started, that longer look-back period may not be what workers have in mind when they assess their annual wage and salary increases at the end of the year. For a broad swath of workers, wages haven't kept up with the cost of living over the past year, and we may continue to see workers pressure their employers to make up the difference or even look for new employers willing to pay for their services.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.