July's Labor Market: Dumbbell-Shaped Dangers

July's Employment Situation report from the Bureau of Labor Statistics received a lot of attention, particularly due to the size of revisions. Nonfarm payroll growth in May was revised down by 125,000 to 19,000, while growth in June was revised down by 133,000 to 14,000. Other aspects of the report were more encouraging. For example, July's unemployment rate of 4.2 percent remained in the range of unemployment readings observed since May 2024 (4.0 percent to 4.2 percent). However, a deeper dive into the unemployment rate's composition reveals signs of broader economic slowdown possibly lurking beneath the current healthy rate.

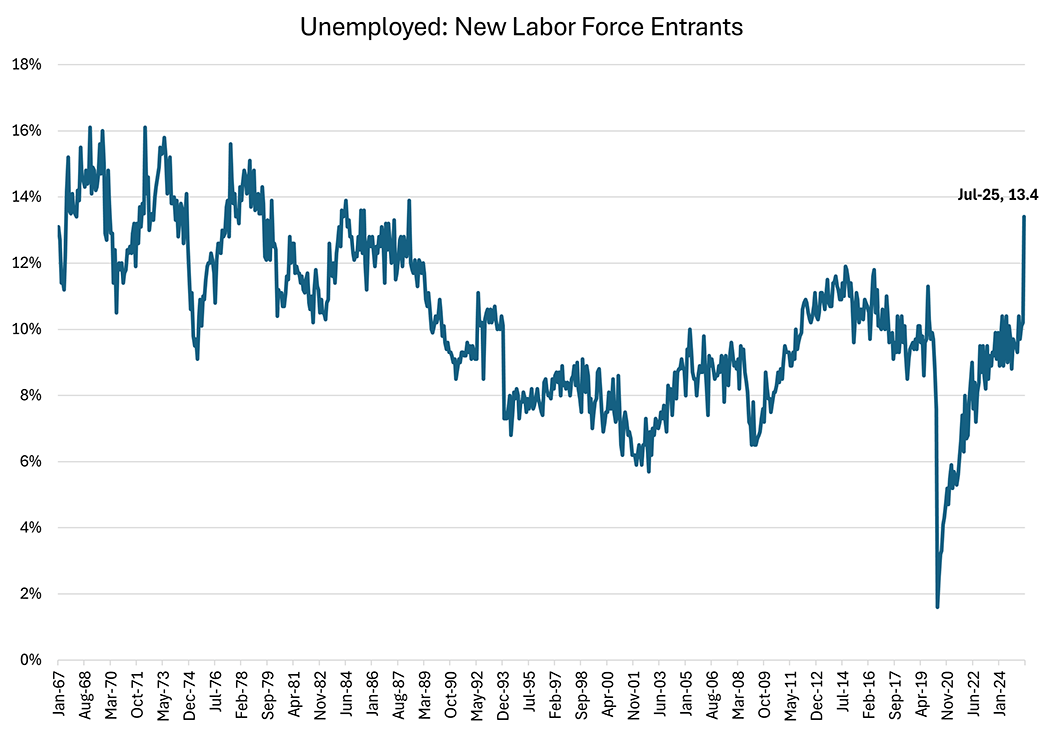

We've previously discussed job-finding challenges for younger and entry-level workers. July's report continued that pattern. In particular, the share of unemployment due to new labor force entrants — that is, people who are looking for jobs and have no previous work experience — rose to 13.4 percent in July, the highest mark since April 1988. (See Figure 1 below.) One possible driver of this increase may be a high level of uncertainty surrounding trade policies. Economic research has found that such uncertainty can have a dampening effect on businesses' hiring and investment plans. (Such research was highlighted in a recent Richmond Fed article on economic policy uncertainty.)

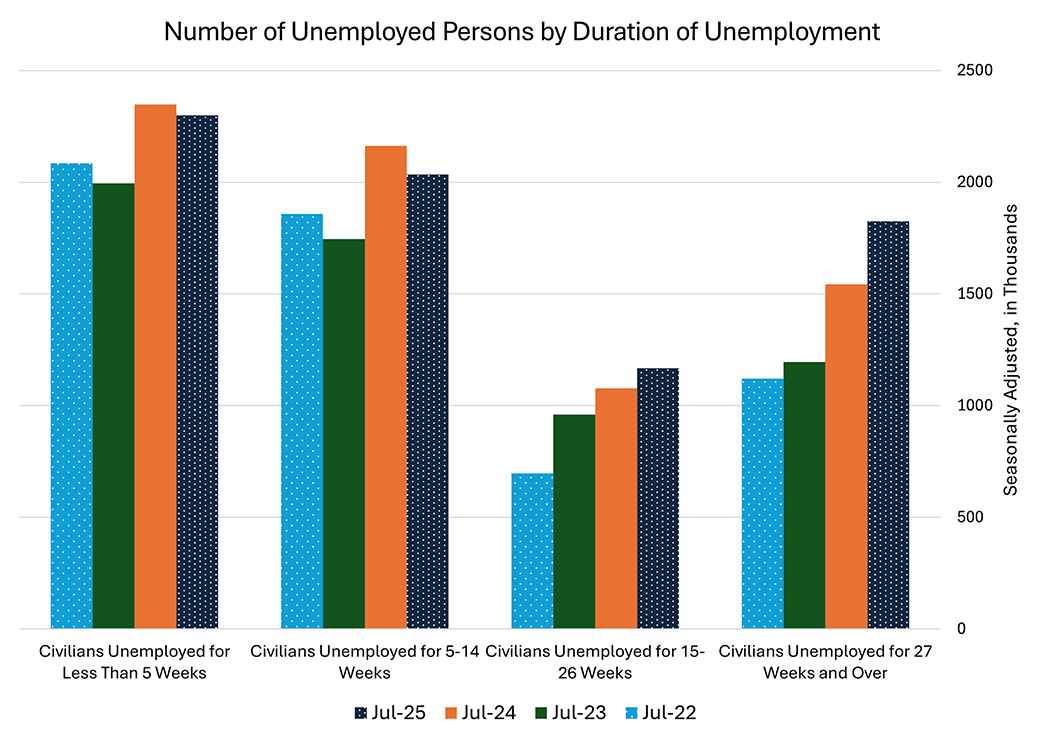

However, challenges are emerging for more than just the newest job seekers. July's household survey also indicates that the number of long-term unemployed — job seekers who have been without a job for at least 27 weeks — has risen steadily and sharply over the last few years. Figure 2 below shows that the rise in long-term unemployment has been steeper than the increase in other duration categories over the past three years.

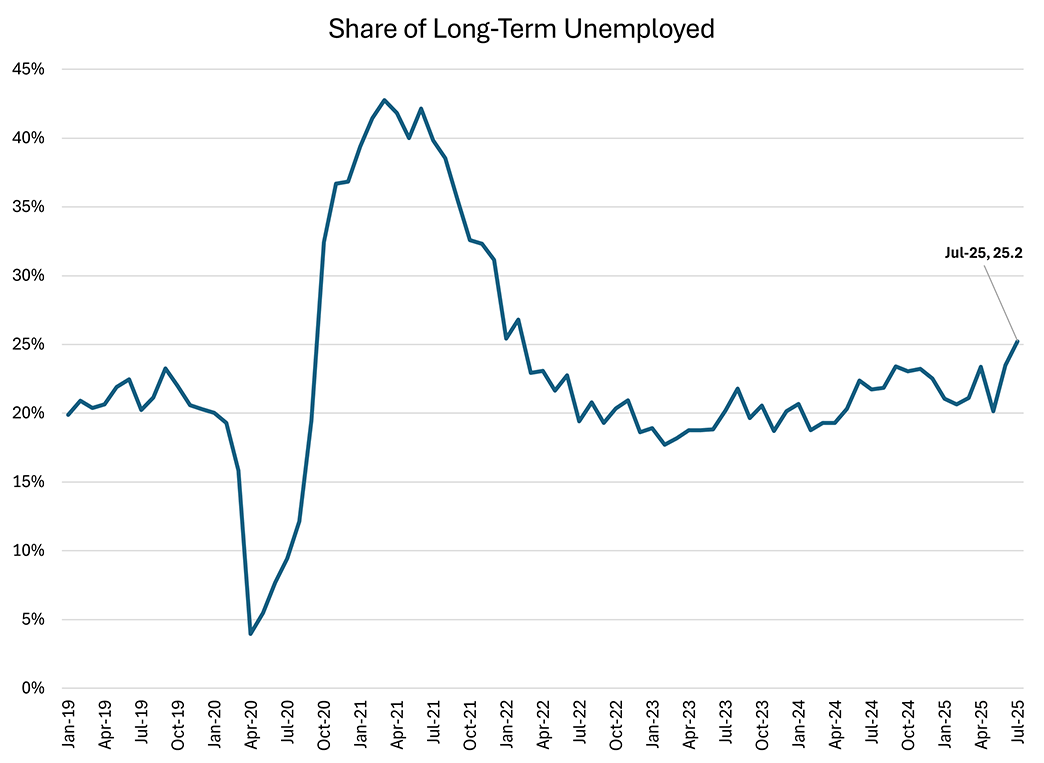

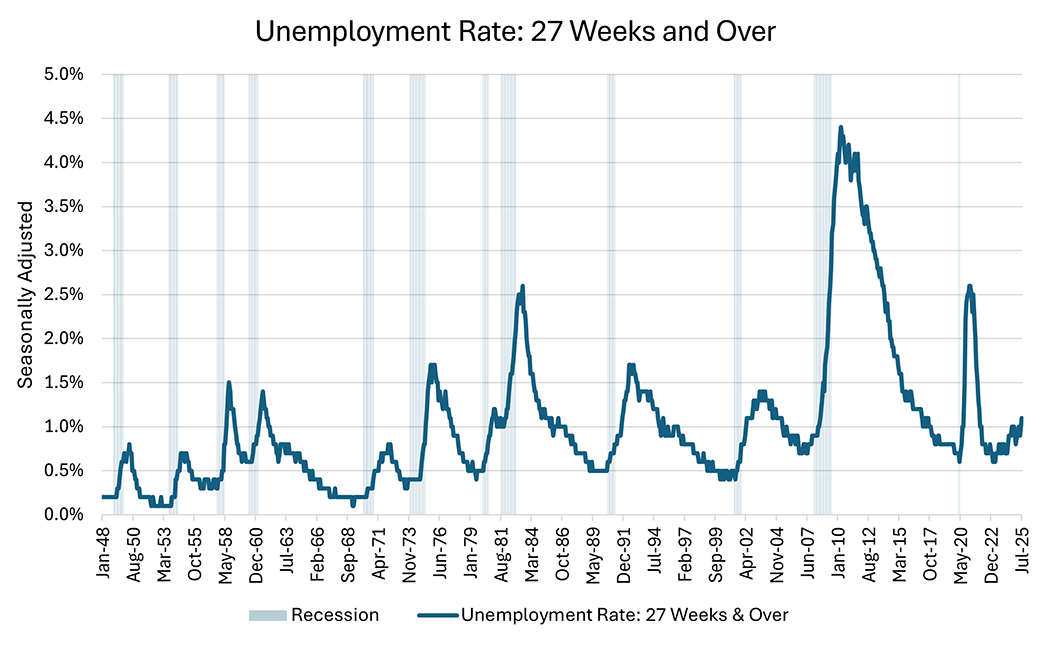

Furthermore, the long-term unemployed now make up 25.2 percent of all unemployed workers, the highest share since February 2022. (See Figure 3 below.) And another way to look at this issue is via the long-term unemployment rate — the number of long-term unemployed divided by the civilian labor force, shown in Figure 4 below — which has been rising since spring 2023. Such an increase is unprecedented outside of recessions. Thus, there are signs of "dumbbell-shaped" danger for the labor market: Both the least experienced and longest unemployed workers are experiencing rising challenges finding jobs.

Views expressed in this article are those of the author and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.