Last week, we released results from the 2025 Survey of Community College Outcomes. This post explores the characteristics of Fifth District community college students and the community college pathways that are often overlooked by traditional graduation rate metrics.

Education

Our research explores the issues and opportunities surrounding education at both the K-12 and postsecondary levels, including the benefits and risks of educational investments.

Updating Results

Updating Results

The first release of findings from the 2025 Survey of Community College Outcomes features aggregate Richmond Fed Success Rates across 189 institutions and highlights the continued value in a community college specific measure of student success.

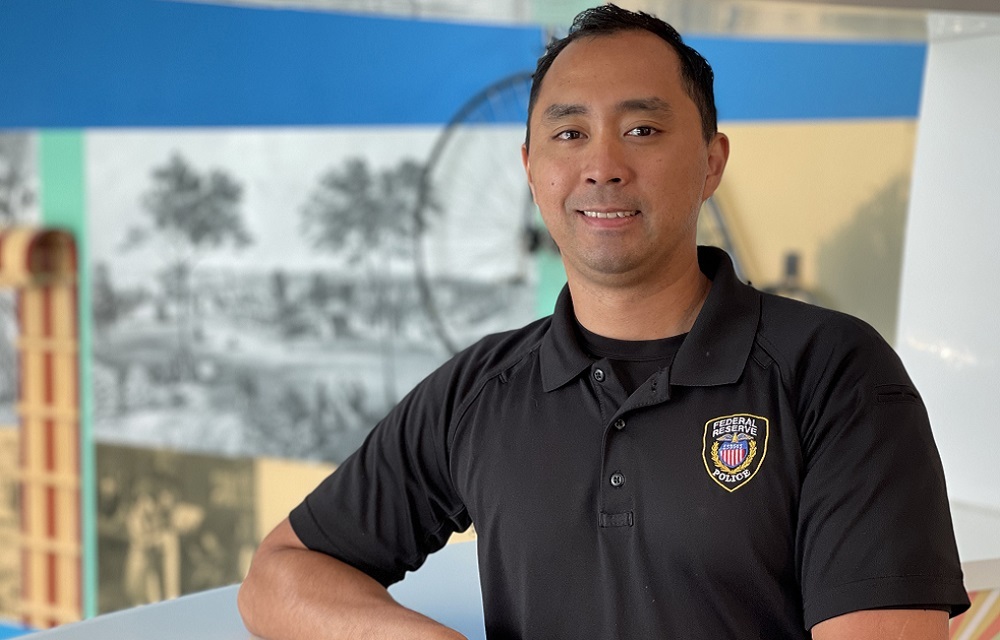

Through initiatives like Invest in What's Next, the Richmond Fed supports a healthy job market by helping students make informed decisions about future work and education pathways.

Congress' passage of H.R.1 (OBBA) has brought new changes to higher education funding, including the establishment of a Workforce Pell Grant program. What does this mean, and how might agencies, institutions, and students respond?

Many rural areas lack sufficient resources to strengthen the STEM pipeline. How is one nonprofit in South Carolina addressing the workforce gap in hopes of reducing rural flight?

Bethany Greene

Regional Economist

Davy Sell and Anthony Tringali discuss the housing needs of community college students and the challenges these institutions face in meeting the demand for affordable options. Sell is a research analyst and Tringali is a research associate at the Federal Reserve Bank of Richmond.

Wraparound services like transportation assistance and child care foster student success. This post highlights how some community colleges are supporting student parents.

Community colleges can leverage a number of creative strategies and partnerships to provide long-term housing solutions for the unique student populations they serve.

Although community college enrollment has increased, housing has also become a growing obstacle for student success.

Stephanie Norris and Matthew Wells discuss their recent research on workforce development programs at community colleges that are aimed at helping the incarcerated re-enter the workforce after they are released. Norris is a senior research analyst and Wells is a senior economics writer, both at the Federal Reserve Bank of Richmond.

New data on credentials earned by undergraduate students show that postsecondary attainment is not a one-size-fits all endeavor.

Stephanie Norris

Associate Director, Community College Initiative

Programs within and outside prison walls provide opportunities for a new beginning.

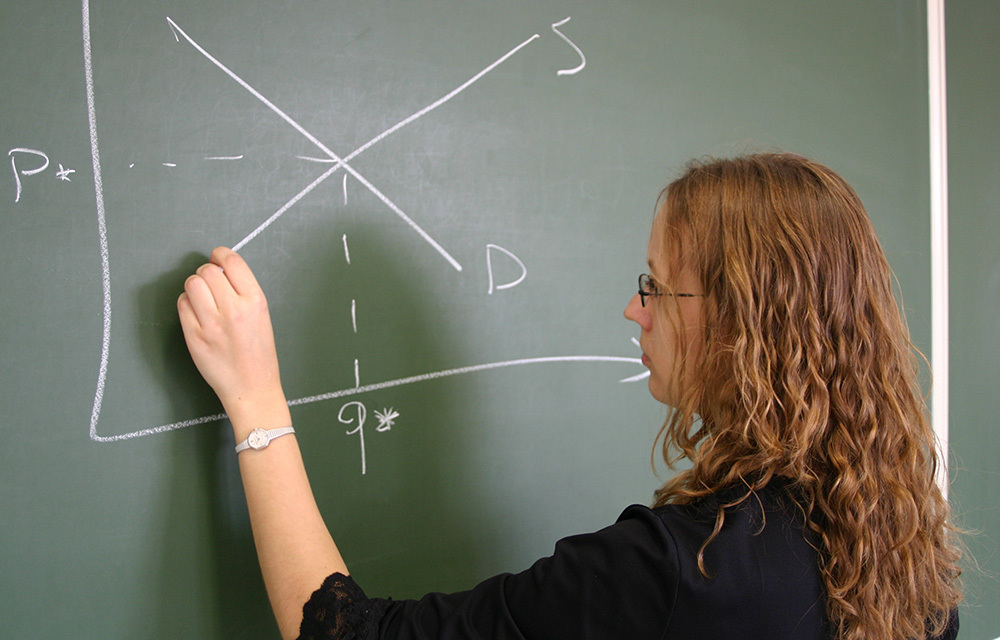

Results from the 2024 Survey of Community College Outcomes indicate that Pell Grant recipients from the 2019-2020 cohort had success rates that lagged their non-Pell Grant recipient peers. While both groups earned associate degrees at roughly the same rate, Pell Grant recipients were less likely to transfer to a four-year institution prior to receiving an award.

Laura Dawson Ullrich

Director, Community College Initiative

This post both updates and corrects a previous post about fall 2024 college enrollment: Total undergraduate college enrollment increased 4.5 percent nationwide compared to fall 2023.

Laura Dawson Ullrich

Director, Community College Initiative

Performance-based funding policies are designed to incentivize institutions to meet a set of performance metrics, and in return, receive additional revenue. However, designing and implementing these models is complex.

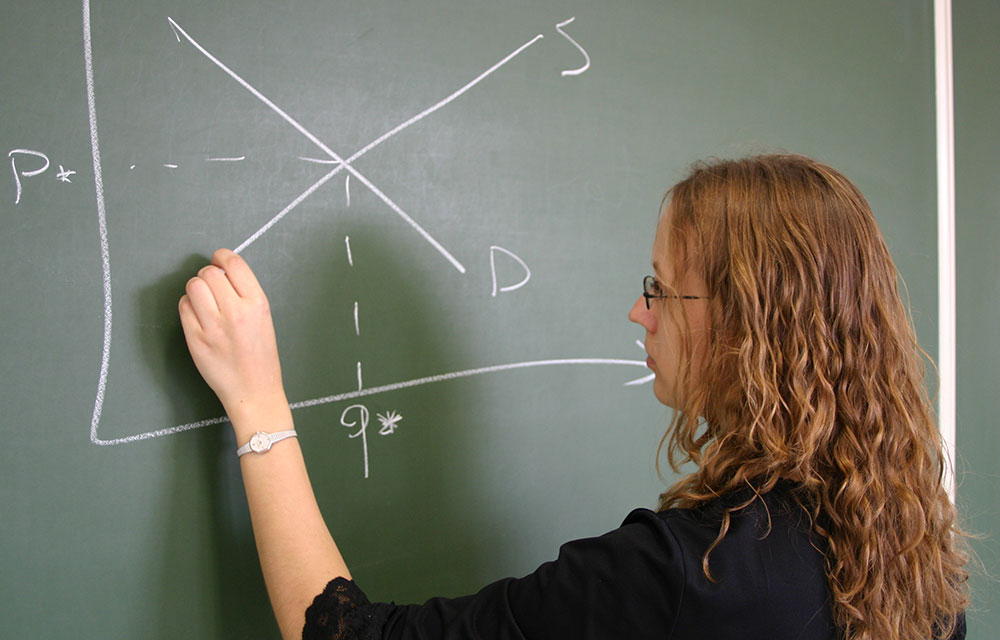

Amanda Neitzel and Santiago Pinto report on the progress of students after the disruptions of the COVID-19 pandemic, differences in the persistence of learning losses, and efforts to remediate these losses. Neitzel is an assistant research professor at the Center for Research and Reform in Education at Johns Hopkins University, while Pinto is a senior economist and policy advisor at the Federal Reserve Bank of Richmond.

Hurricane Helene caused widespread destruction across the Fifth District. Two community college presidents in North Carolina shared how the storm impacted their institutions and the role they have played in the recovery efforts.

Anthony Tringali, James Melton and Laura Dawson Ullrich

Laura Ullrich and Stephanie Norris dive into the initial results of the 2024 Survey of Community College Outcomes, including information on completion rates, transfer rates, and enrollment at more than 120 community colleges in five states. Ullrich and Norris are the director and associate director, respectively, of the Richmond Fed's Community College Initiative.

The Richmond Fed's community college team recently unveiled results of the 2024 Survey of Community College Outcomes during a webinar that highlighted key findings and insights from two community college presidents.

The Survey of Community College Outcomes aims to capture the positive outcomes and critical role community colleges play in the workforce development needs of their communities.

Tom Barkin

President and Chief Executive Officer

In 2024, 121 schools from across all five states in the Fifth District participated in the Survey of Community College Outcomes. We also expanded our survey to include more detailed data on community college wraparound services.

In 2024, 121 schools from across all five states in the Fifth District participated in the Survey of Community College Outcomes. We also expanded our survey to include more detailed data on community college wraparound services.

Recent research suggests that there are meaningful differences in the content of recommendation letters correlated with gender, race and ethnicity.

People change jobs over time, but they are likely to remain in the industries that are most highly tied to their initial fields of study.

Joseph Mengedoth

Regional Economist

A preview of the NSC's fall 2024 college undergraduate enrollment is here, and as anticipated, freshmen enrollment appears to have declined, although total enrollment is up.

Laura Dawson Ullrich

Director, Community College Initiative

Wraparound services offer a wide range of support that may otherwise prevent students from completing their education. However, funding wraparound services at community colleges can be challenging.

A sneak peek at results provides some insights on what makes a community college successful, often influenced by the types of students they serve and their local workforce development needs.

Deborah Diamond and Adam Scavette discuss how anchor institutions such as universities and hospitals fit into the economic life of communities. Diamond is director of the Anchor Economy Initiative at the Federal Reserve Bank of Philadelphia and Scavette is a regional economist at the Baltimore office of the Federal Reserve Bank of Richmond.

Recently released evidence from the NCES indicates the prevalence of personal and educational disruptions on community college students, but more detailed data would be needed to see the entire picture.

Stephanie Norris

Associate Director, Community College Initiative

Just 75 minutes from Richmond, Farmville and its surrounding counties are an idyllic setting for bargain hunters and outdoor adventurers alike. The area's economic landscape is notably shaped by its educational institutions and agricultural roots, alongside other attractions. Recently, our Community Conversations Team made a visit to the area to learn more about their economic strengths and opportunities.

Although the communities surrounding universities experienced some shielding effects from previous recessions, the unemployment rate actually increased in these areas following the COVID-19 recession.

As we wrap up data collection for 2024 and prepare to release our results in November, this post highlights what we've done so far, what we're working on, and future plans for the project.

Laura Dawson Ullrich

Director, Community College Initiative

Initial IPEDS estimates show community colleges serve almost 75 percent of dually enrolled students nationwide, and there is significant variation across states, institution types, and student demographics.

Stephanie Norris

Associate Director, Community College Initiative

The credential-jobs misalignment among middle-skill workers has an impact on the economy, causing inefficiencies in employer-employee matching. Rethinking how community colleges and universities approach transfer agreements could provide better alignment.

David Cox, Adin Hammond and Tyrese Wheaton describe their summer at the Federal Reserve Bank of Richmond interning in three different departments.

With an anticipated decline in the college-age population, high costs of four-year degrees, and changing demands among employers, parents, and students, higher education seems to be at a crossroads.

College degree attainment is associated with higher labor force participation, and although better data is needed to understand fully, this seems to also be true for those who have some college but no degree.

Stephanie Norris and Laura Ullrich explain how an effort to make it easier for prospective college students to apply for federal financial aid has had ripple effects on enrollment at community colleges and other institutions of higher education. Norris is a senior research analyst and Ullrich is a senior regional economist at the Richmond Fed.

How has college tuition trended recently, and why?

Grey Gordon, Aaron Hedlund and Brennan Merone

Community colleges serve students in many ways depending on their educational goals, so much of the value these institutions provide for their communities is overlooked when measuring success.

Stephanie Norris

Associate Director, Community College Initiative

This paper provides evidence on the regional resiliency impact of research universities by estimating the effects of recent U.S. recessions on local unemployment.

The looming FAFSA crisis has continued into June, likely leading to a decrease in enrollments for grant and federal loan dependent schools. In turn, community colleges may see an enrollment increase.

Laura Dawson Ullrich

Director, Community College Initiative

Historically, most higher education state and local spending has gone to four-year institutions. As community colleges play an increasing role in training workers for high-demand jobs, have funding patterns kept up?

Issues surrounding the new FAFSA form have led to a sharp decline in form completions for the coming academic year. This could result in overall enrollment declines across higher education, but it is likely to hit some groups of students and institutions harder than others.

Borrowers didn't have to make payments for three and a half years. How will they — and the economy — weather a rapidly changing student loan landscape?

The motivations behind the new gainful employment policy are noble, but community colleges, especially in rural areas, could be disproportionately harmed by the earnings premium test.

In this article, we discuss the history and motivation of federal gainful employment legislation and what the new rules entail.

Laura Ullrich and Jacob Walker review data they have gathered from the Richmond Fed Survey of Community College Outcomes about high school students who take dual enrollment classes. They also discuss differences in how these classes are funded.

Dual enrollment programs can play an important role in creating a strong, educated workforce, but they need to make sure the funding policies are available and effective.

Community colleges offer non-credit workforce training programs that prepare students for high-demand jobs. Data on these programs and their students are limited. The Richmond Fed's Survey of Community College Outcomes aims to bridge the data gap.

Laura Dawson Ullrich and Jacob Walker

Pell Grants make community college more accessible for low-income students, but those enrolled in non-credit coursework aren't eligible. Expanding eligibility would be significant for both institutions and students.

Jacob Walker

Data on dual enrollment programs is limited, but through the Richmond Fed's Survey of Community Colleges Outcomes, we now have a better understanding of how Fifth District community colleges serve high school students and how these students perform.

Jacob Walker

Community colleges started out as junior colleges and meant to restrict access to higher education. However, they have evolved to increase access to higher education and the workforce.

Laura Dawson Ullrich

Director, Community College Initiative

Upcoming Event: What do Uber and the Federal Reserve have in common? They both hire economists! Did you know that some of your favorite brands also hire economists? But what do economists actually do? Registration required.

Laura Ullrich provides an update on the Richmond Fed Survey of Community College Outcomes, which aims to provide more accurate and detailed data on the performance of community colleges and their students. Ullrich is a senior regional economist at the Charlotte branch of the Federal Reserve Bank of Richmond.

In order to observe Fifth District community college outcomes, we decided to collect consistent data that would enable us to calculate a new success metric: the Richmond Fed Community College Success Rate.

Jason Kosakow, Laura Dawson Ullrich and Jacob Walker

Upcoming Event: The general public is invited to join the Richmond Fed on Wednesday, Nov. 15 for an enlightening conversation on the evolving role community colleges play in workforce development. Registration required.

The Federal Reserve Bank of Richmond has developed the Survey of Community College Outcomes to better define student and institution success and to provide insight into the wide variety of programs offered and students served across the Fifth District. After a successful initial pilot in 2022, The Federal Reserve Bank of Richmond moved into an extended pilot phase in 2023. Join Richmond Fed leaders Laura Ullrich and Jason Kosakow, along with two community college administrators, to learn more about the survey and its goals, and to view results from the extended pilot.

Community colleges differ from four-year institutions in important ways, but they are often measured by the same metrics.

Laura Dawson Ullrich

Director, Community College Initiative

Santiago Pinto provides evidence of learning losses among K-12 students during the COVID-19 pandemic. He also discusses the causes, distribution and consequences of these losses. Pinto is a senior economist and policy advisor at the Federal Reserve Bank of Richmond.

Funding formulas for higher education have traditionally been based primarily on full-time equivalent enrollment. This creates disparities between funding for four-year institutions and community colleges that may worsen over time.

Laura Dawson Ullrich

Director, Community College Initiative

The STEM East initiative aims to show students in eastern North Carolina how they can stay and thrive in their home communities.

North Carolina has taken dual enrollment/dual credit one step further with its Cooperative Innovative High Schools: high schools that are specifically designed for co-enrollment at a university or community college.

Jacob Walker

HEERF dollars helped community colleges and their students withstand pandemic disruptions. But schools that used the money for revenue replacement or other recurring items may have difficulty operating in a post-HEERF world.

Laura Dawson Ullrich and Meher Narielvala

How far behind did students get during the pandemic, why did they get behind, and how can they catch up?

As the economy continues to normalize from the shock of the pandemic, what changes have we seen in terms of mothers' labor force participation?

Erin Henry and John O'Trakoun

A recent study suggests that admission restrictions for certain college majors are pushing some students into lower-earning career paths. What could this mean for students transferring from community colleges to four-year institutions in the Fifth District?

Jacob Walker

Join fellow economic educators as Federal Reserve Bank education specialists share their content knowledge and lots of complimentary teaching tools for the economics classroom.

Community college graduation rates lag those of their four-year counterparts in the Fifth District. Is this evidence of failure or mismeasurement?

Jacob Walker and Laura Dawson Ullrich

The calculation of college graduation rates is complicated, and many community college students are left out of the formula altogether.

Laura Dawson Ullrich

Director, Community College Initiative

A large number of high school students attend community college in the United States, with higher rates observed in rural areas. While this enrollment trend has grown over the past twenty years, data on these students' success has not.

Laura Dawson Ullrich

Director, Community College Initiative

Non-credit programs provide community college students an opportunity to obtain shorter-term training and credentials. These programs are becoming more popular, but we currently know very little about non-credit students.

Laura Dawson Ullrich

Director, Community College Initiative

Even though Black and White college graduates borrow similar amounts for school, Black grads are significantly more likely to default on student loans.

Sierra Latham and Sarah Gunn discuss the current shortage of teachers nationally and in the Fifth Federal Reserve District, how supply-demand forces have contributed to this labor market gap, and what is happening in response. Latham is a senior research analyst and Gunn is director of economic education at the Federal Reserve Bank of Richmond.

Many students use two-year colleges to determine whether they should go on to a four-year college.

Samira Gholami and Nicholas Trachter

Hispanic postsecondary enrollment has nearly doubled in the Fifth District over the past decade, contributing to increased diversity across college campuses. Organizations work to engage Hispanic youth throughout the college application and attendance process to ensure their success as college students.

Monetary policy, marriage, college admissions, and discrimination and socioeconomic outcomes were among the topics discussed at our recent conference.

After accounting for cost of living, teachers' salaries go further in some rural communities throughout the Fifth District.

Grey Gordon discusses his research and other economists' work on the macroeconomic and policy factors that shape the price of higher education. Gordon is a senior economist at the Federal Reserve Bank of Richmond.

The Richmond Fed's Survey of Community College Outcomes presents a new way to measure success that includes previously underrepresented cohorts of students, including those receiving Pell grants.

Laura Dawson Ullrich and Jacob Walker

States and school districts are using a variety of policies — including financial incentives — to try to combat a teacher shortage.

To the best of their ability, school districts set salary and benefit schedules to be competitive with outside employment opportunities.

There can be high returns to earning an economics degree, helping to draw students to the profession.

John Mullin

President Tom Barkin explores some of the crucial segments lagging behind in the jobs recovery.

Tom Barkin

President, Federal Reserve Bank of Richmond

Some believe rises in financial aid such as student loans cause corresponding rises in tuition. But reality seems much more nuanced.

Grey Gordon and Aaron Hedlund

How many more borrowers working in public services recently became eligible for student loan forgiveness in the Fifth District?

Elizabeth Link, Jessie Romero and Sarah Turner

How does immigration policy impact economic growth? Do firms that hire more skilled immigrants perform better? These and other questions were addressed during a recent Richmond Fed conference.

Abhimanyu Banerjee

Laura Ullrich and Jason Kosakow discuss how community colleges contribute to their local economies, especially rural communities, and how their new survey addresses knowledge gaps about these important contributions. Ullrich is a regional economist based at the Richmond Fed's Charlotte office and Kosakow is the Bank's survey director.

Fewer veterans are using their education benefits. Is this trend a problem — or a sign of a more welcoming job market?

Numerous factors — including population growth, education, housing, transportation, child care, health, and broadband availability — are shaping the differences in employment outcomes between rural and urban communities.

This new system for measuring community college outcomes better reflects how the institutions are serving their students and communities than current data collection methods.

Learning loss has the potential to set students back for years to come, affecting not only their development, but also the economy.

For the 50th episode of the podcast, hosts Jessie Romero, Charles Gerena and Tim Sablik use previous episodes to explore how labor markets are shaped by the economic choices we make throughout our lifetimes, from childhood to adulthood to old age.

Mark Bils of the University of Rochester and Niklas Engbom of New York University discuss their research on how easily labor is substituted or shifted between jobs and its implications for policies to bolster human capital.

Will four-year degrees become less of a gateway for high-paying jobs? Should they?

Neeraja Deshpande

Rural America Week brings together community leaders, policymakers, and representatives from financial institutions and foundations.

Laura Ullrich and Urvi Neelakantan discuss trends in enrollment at community colleges and the role of these educational institutions in the economy.

In Florence County, the Southeastern Institute of Manufacturing Technology and its Gould Business Incubator are fostering an entrepreneurial ecosystem and fueling small business development in South Carolina.

Erika W. Bell

Regional Manager

While all sectors of higher education have experienced declines, community colleges have been hardest hit: this fall, community college enrollment declined significantly for the second consecutive year.

Laura Dawson Ullrich

Director, Community College Initiative

Maia Linask and Tatyana Avilova share their career journeys in the field of economics and discuss what motivated them to organize the Diverse Economics Conference this November.

The Danville region in Virginia has moved the needle on early childhood education and now has an ecosystem in place to help address future challenges.

Renee Haltom

Vice President and Regional Executive

Angela Wells, executive director of Smart Beginnings Danville Pittsylvania, discusses how her Southside Virginia organization supports parents, schools and early child care providers in preparing children for success in school and in life.

Vance-Granville Community College's early college high schools and workforce programs are improving education and job opportunities for area residents.

Laura Dawson Ullrich and Lucas Moyon

People who pay student loans back using income-driven repayment plans are less likely to default than those who use standard repayment plans.

Sarah Gunn, Nicholas Haltom and Urvi Neelakantan

President Tom Barkin shares what he learned from conversations with educators and policymakers about the effects of the COVID-19 pandemic on students.

Tom Barkin

President, Federal Reserve Bank of Richmond

What explains diverging employment outcomes for college graduates and older workers? Read more in President Tom Barkin’s latest essay.

Tom Barkin

President, Federal Reserve Bank of Richmond

Regional economist Laura Ullrich shares her insights on historically black colleges and universities and their role in workforce development and the economy in general.

Community college enrollment declined significantly across the country in fall 2020, breaking the typical pattern of increased enrollment during a recession.

Roisin McCord and Laura Dawson Ullrich

For Financial Literacy Month, two teachers in South Carolina discuss how they help high school students learn about economics and personal finance.

Amid the COVID-19 pandemic, public school enrollment has decreased overall and across racial groups, with the steepest declines in grades Pre-K through elementary.

Hailey Phelps

Andy Bauer provides an update on economic conditions in Maryland as the state recovers from the severe downturn caused by the COVID-19 pandemic.

Kartik Athreya shares his experiences on the Back to Work Virginia Task Force, which is developing policies and practices for strengthening the child care industry.

UC San Diego economics professor on fiscal stimulus, technological lull, and the rug-rat race.

David A. Price

The number of women in economics decreases at every professional step, starting at the undergraduate level.

Hailey Phelps

President Tom Barkin talks about the effects of COVID-19 on students and the Richmond Fed’s new District Dialogues series exploring educational disparities.

Tom Barkin

President, Federal Reserve Bank of Richmond

Alex Marré discusses the ongoing challenges of bringing broadband Internet service to everyone who needs it.

Richmond Fed president Tom Barkin discusses how community colleges can help workers affected by COVID-19 job loss.

Tom Barkin

President, Federal Reserve Bank of Richmond

Santiago Pinto discusses the potential long-term consequences of disruptions to K-12 education as a result of the COVID-19 pandemic.

The COVID-19 pandemic is forecast to negatively affect state and local government revenues. In the absence of sizable federal transfers, this is likely to disrupt spending on critical services — including education — in ways that may have long-lasting effects.

John Mullin and Santiago M. Pinto

Richmond Fed president Tom Barkin spoke about the importance of early childhood education and the health of the child care industry at the VECF/VA Chamber’s 7th Annual Executive Briefing on the Economics of Early Childhood.

Tom Barkin

President, Federal Reserve Bank of Richmond

As the COVID-19 pandemic forced schools to shift their approach to instruction, the Fed and other economic and financial literacy organizations pivoted, too.

Sarah Gunn, Nicholas Haltom and Donovan Pearce

Research indicates that one promising strategy for rural development is maintaining and improving the quality of an area's public schools.

Alexander Marre, David A. Price and Anil Rupasingha

Richmond Fed president Tom Barkin discusses racial inequality in the Fifth District and how the Richmond Fed is working to make a positive difference.

Tom Barkin

President, Federal Reserve Bank of Richmond

Some schools are offering to buy a share of students' future income in exchange for funding their education.

MIT economist on charter schools, the elite illusion, and the "Stones Age" of econometrics.

David A. Price

According to Marx and Turner, receiving a nonzero loan offer increases students' likelihood of borrowing, which, on average, increases educational attainment.

Molly Harnish

Northwestern University economist on firms' investment decisions, intangible capital, and the college premium

Community colleges serve a larger share of minority students than public or private four-year schools.

Laura Dawson Ullrich

Director, Community College Initiative

College attainment differs greatly between Fifth District counties, as do unemployment rates and earnings by education level from state to state.

Richmond Fed President Tom Barkin highlighted themes for rural communities — education, jobs, de-isolation, and participation — at the Virginia Governor's Conference on Agricultural Trade.

Tom Barkin

President, Federal Reserve Bank of Richmond

Although changes in educational attainment, employment status, and median earnings were inconsistent across Fifth District jurisdictions in 2017, most saw lower unemployment and higher median earnings.

Joseph Mengedoth

Regional Economist

Richmond Fed President Tom Barkin delivered remarks to a Federal Reserve conference on minorities in banking.

Tom Barkin

President, Federal Reserve Bank of Richmond

In 2016, every Fifth District jurisdiction, along with the nation, saw an increase in the share of the over-25 population with a bachelor's degree or higher. What else changed since 2015?

Joseph Mengedoth

Regional Economist

There are large differences across school districts in enrollment and attendance at high-resource colleges and universities.

Emily E. Cook, Jessie Romero and Sarah Turner

This post takes a look at the current state of educational attainment across jurisdictions and highlights some of the information available in new reports published by the Richmond Fed.

Michael Stanley

Presidents Message

President Lacker addresses the National Council for Economic Education

Jeffrey M. Lacker

President, Federal Reserve Bank of Richmond

Reviews the Bank's operations and includes the article entitled "The Financial Crisis: Toward an Explanation and Policy Response"